Personal Finance Hacks That Actually Work for Millennials

Personal finance hacks millennials can trust are essential in today’s fast-paced world. Managing money wisely is key to achieving financial freedom, especially for millennials who face unique challenges like student debt, rising living costs, and economic uncertainties. This guide shares proven, powerful personal finance hacks that actually work, helping millennials save, invest, and grow wealth with confidence.

Why Personal Finance Hacks Millennials Trust Matter

Millennials often juggle multiple financial priorities from paying off loans to saving for homes and retirement. Personal finance hacks that simplify money management and deliver real results are invaluable.

Top Personal Finance Hacks Millennials Should Use

1. Automate Your Savings to Build Wealth Effortlessly

Automating savings ensures consistent contributions without relying on willpower.

| Hack | How It Works | Benefits |

|---|---|---|

| Automatic Transfers | Set up monthly transfers to savings | Builds savings painlessly |

| Round-Up Apps | Round purchases to save spare change | Small amounts add up fast |

Case Study:

Jessica automated $200 monthly to a high-yield savings account. Over two years, she saved $4,800 effortlessly, which she used as an emergency fund.

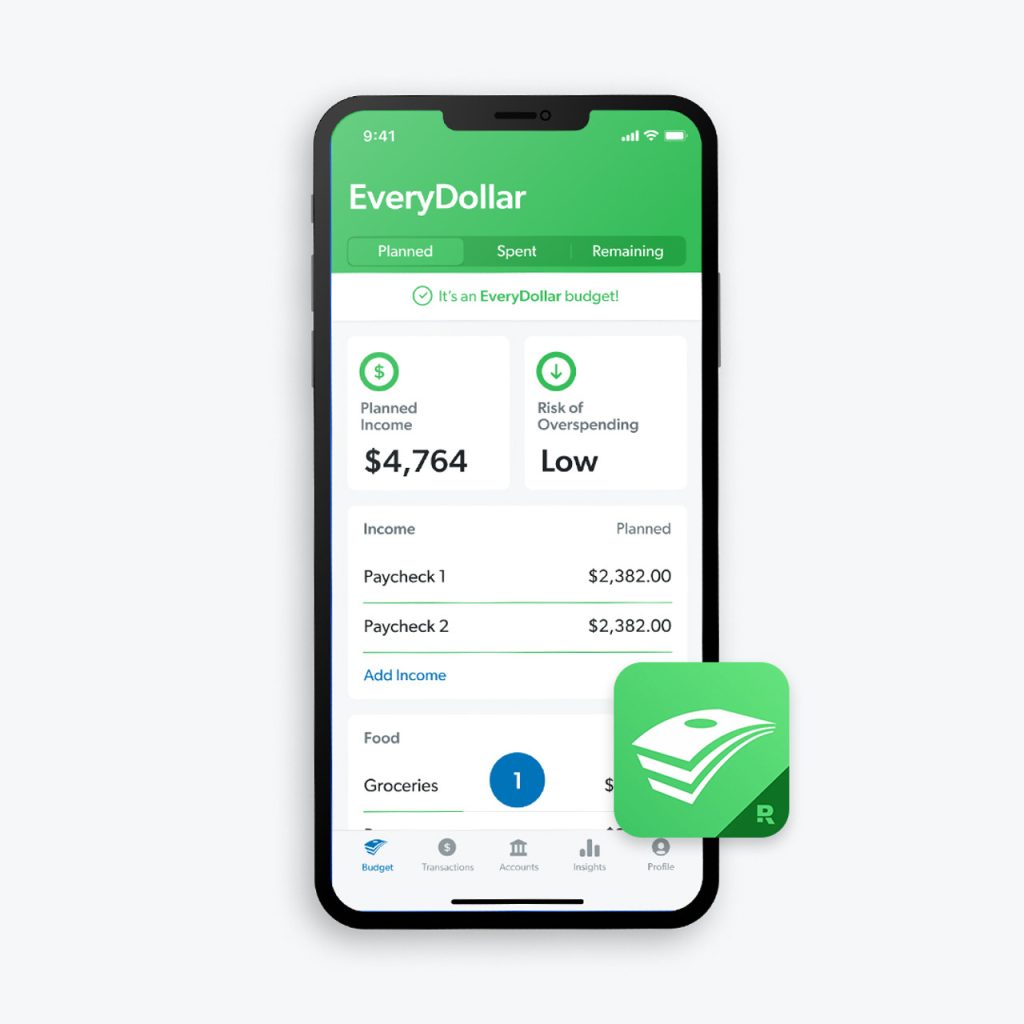

2. Use Budgeting Apps to Track Every Dollar

Apps like Mint, YNAB, or PocketGuard help millennials monitor spending and find saving opportunities.

- Categorize expenses automatically.

- Set spending limits and get alerts.

- Visualize financial goals progress.

3. Pay Off High-Interest Debt First

Tackling high-interest debt like credit cards saves money on interest and improves credit scores.

| Debt Type | Average Interest Rate | Recommended Strategy |

|---|---|---|

| Credit Cards | 15-25% | Pay off aggressively |

| Student Loans | 4-7% | Pay steadily |

| Personal Loans | 8-12% | Prioritize based on rates |

Case Study:

Mark focused on paying off his $5,000 credit card balance first, saving over $1,200 in interest compared to minimum payments.

4. Invest Early and Regularly, Even Small Amounts

Compound interest works best over time. Starting early, even with small amounts, grows wealth significantly.

- Use robo-advisors or micro-investing apps.

- Contribute to employer 401(k) plans or IRAs.

- Reinvest dividends.

5. Take Advantage of Cashback and Rewards Programs

Maximize spending by using credit cards or apps offering cashback and rewards.

- Pay balances in full to avoid interest.

- Use rewards for travel, groceries, or bills.

6. Build Multiple Income Streams

Diversify income to increase financial security.

- Freelance or side gigs.

- Passive income via rental properties or dividends.

7. Educate Yourself Continuously on Personal Finance

Stay updated with blogs, podcasts, and books to make informed decisions.

How Millennials Can Overcome Financial Challenges

- Managing student loans smartly.

- Navigating housing market hurdles.

- Handling economic uncertainty.

The Psychology Behind Money Habits in Millennials

- Understanding spending triggers.

- Building discipline with positive reinforcement.

Tools and Resources Millennials Should Use

- Best apps for budgeting, investing, and saving.

- Online communities and courses.

Understanding Millennial Financial Challenges in 2025

Personal Finance Hacks Millennials need must address unique financial hurdles this generation faces today.

Key Challenges Millennials Face

| Challenge | Description | Impact on Finances |

|---|---|---|

| High Student Loan Debt | Average US millennial owes ~$37,853 in student loans, limiting savings and investment. | Delays homeownership, retirement savings. |

| Expensive Housing Market | Rising rents and home prices consume 30-40% of income globally. | Limits disposable income and savings. |

| Credit Card and BNPL Debt | Growing reliance on credit cards and Buy Now, Pay Later (BNPL) services. | Increases debt servicing costs. |

| Stagnant Real Wages | Wages have not kept pace with inflation and rising living costs. | Reduces purchasing power. |

| Gig Economy & Job Instability | Many millennials work freelance or gig jobs without benefits or steady income. | Complicates budgeting and saving. |

Case Study: Millennial Debt Burden

Jessica, a 32-year-old marketing professional, carries $45,000 in student loans and $5,000 in credit card debt. Despite earning a $60,000 salary, her debt payments consume 35% of her income, making saving difficult.

Millennial Spending Patterns: Where Does the Money Go?

Understanding spending habits helps identify areas for effective personal finance hacks.

| Spending Category | % of Average Millennial Income | Notes |

|---|---|---|

| Housing & Rent | 30-40% | Largest expense, especially in urban areas |

| Groceries & Food | 15-20% | Essential but rising due to inflation |

| Travel & Experiences | 10-15% | High priority for millennials |

| Tech & Subscriptions | 8-12% | Includes streaming, apps, and gadgets |

| Fashion & Beauty | 5-8% | Value-conscious but experience-driven |

| Health & Wellness | 5-10% | Includes gym, therapy, and supplements |

| Financial Tools & Investing | 2-5% | Growing interest in financial literacy |

Insight

Millennials prioritize experiences and wellness but also invest in financial tools, indicating openness to personal finance hacks that align with their values.

Behavioral Finance: Why Personal Finance Hacks Millennials Need Must Address Psychology

Financial decisions are influenced by behavior and mindset. Effective hacks consider these factors.

Common Behavioral Barriers

- Impulse Spending: Driven by social media and lifestyle pressures.

- Short-Term Focus: Prioritizing immediate gratification over long-term goals.

- Financial Anxiety: Stress from debt and economic uncertainty leads to avoidance.

- Overconfidence: Belief in future income growth can lead to overspending.

Hack: Use Behavioral Nudges

- Automate savings and bill payments to reduce decision fatigue.

- Set clear, measurable goals with rewards for milestones.

- Use apps that provide real-time spending feedback.

Advanced Personal Finance Hacks Millennials Can Use

1. Leverage Employer Benefits Fully

Many millennials underutilize benefits like 401(k) matching, health savings accounts (HSAs), and wellness programs.

| Benefit Type | How to Use Effectively | Financial Impact |

|---|---|---|

| 401(k) Match | Contribute enough to get full employer match | Free money and compound growth |

| Health Savings Account | Use pre-tax dollars for medical expenses | Reduces taxable income and healthcare costs |

| Flexible Spending Account | Pay for eligible expenses tax-free | Saves money on healthcare and childcare |

| Employee Discounts | Use for travel, tech, and wellness | Reduces discretionary spending |

2. Optimize Credit Use and Score

Good credit unlocks better loan rates and financial products.

- Pay credit card balances in full monthly.

- Keep credit utilization below 30%.

- Check credit reports regularly for errors.

3. Adopt the “Pay Yourself First” Strategy

Prioritize saving by automatically transferring a portion of income to savings or investments before spending.

Case Study: How Millennials Successfully Use Personal Finance Hacks

Case Study: Alex’s Journey to Financial Stability

Alex, 29, started with $20,000 in student loans and minimal savings. By automating $300 monthly savings, using budgeting apps, and focusing on debt repayment, he became debt-free in 3 years and built a $15,000 emergency fund. He now invests regularly and plans to buy a home by 2027.

Tools and Resources for Millennials

| Tool/App Name | Purpose | Key Features |

|---|---|---|

| Mint | Budgeting and expense tracking | Automatic categorization, alerts |

| YNAB (You Need A Budget) | Budgeting and goal setting | Real-time tracking, educational content |

| Robinhood | Investing | Commission-free trades, easy interface |

| Acorns | Micro-investing | Rounds up purchases to invest spare change |

| Credit Karma | Credit score monitoring | Free credit reports, personalized tips |

How Millennials Can Overcome Common Financial Pitfalls

| Pitfall | How to Avoid | Personal Finance Hack |

|---|---|---|

| Lifestyle Inflation | Avoid increasing spending with income increases | Automate savings to maintain saving rate |

| High-Interest Debt | Prioritize paying off credit cards and loans | Use debt avalanche or snowball methods |

| Lack of Emergency Fund | Build 3-6 months of expenses in liquid savings | Start small and automate contributions |

| Ignoring Retirement | Start early, even with small contributions | Use employer plans and IRAs |

Millennials and the Future of Personal Finance

Millennials are shaping financial trends with a focus on sustainability, digital tools, and financial wellness.

- Preference for socially responsible investing.

- Growing use of fintech and AI-powered financial advisors.

- Emphasis on financial education and transparency.

Cultivating a Wealth Mindset for Financial Success

A powerful personal finance hack millennials often overlook is developing a wealth mindset. This means shifting your attitude about money from scarcity to abundance and focusing on long-term financial health.

Key Elements of a Wealth Mindset

- Delayed Gratification: Prioritize long-term goals over short-term pleasures.

- Growth Orientation: View financial setbacks as learning opportunities.

- Value-Based Spending: Align spending with your core values and goals.

- Financial Confidence: Educate yourself to make empowered money decisions.

How to Develop a Wealth Mindset

- Practice gratitude for what you have.

- Set clear, meaningful financial goals.

- Surround yourself with financially savvy peers or mentors.

- Read books like “Think and Grow Rich” or “Atomic Habits” for mindset inspiration.

Designing a Lifestyle That Supports Financial Goals

Millennials can hack their finances by intentionally designing a lifestyle that reduces unnecessary expenses and supports saving and investing.

Lifestyle Design Tips

- Minimalism: Reduce clutter and consumption to save money and focus on essentials.

- Smart Housing Choices: Consider co-living, renting in affordable neighborhoods, or house hacking.

- Transportation Savings: Use public transit, bike, or carpool to cut costs.

- Meal Planning: Cook at home more often to reduce food expenses.

Case Study: Minimalist Millennial Saves Big

Lena downsized her apartment and cut monthly expenses by 30%, redirecting savings into her investment portfolio. She reached her first $10,000 investment milestone in under two years.

Tax Optimization Hacks for Millennials

Understanding and optimizing your taxes is a critical but often overlooked personal finance hack.

Tax Hacks to Consider

- Maximize Retirement Contributions: Contributions to 401(k)s or IRAs reduce taxable income.

- Use Health Savings Accounts (HSAs): Triple tax advantage—contributions, growth, and withdrawals for medical expenses are tax-free.

- Claim All Eligible Deductions and Credits: Education credits, student loan interest deductions, and earned income credits can reduce tax liability.

- Consider Tax-Loss Harvesting: Offset capital gains by selling losing investments.

Common Tax Benefits for Millennials

| Tax Benefit | Description | Potential Savings |

|---|---|---|

| 401(k) Contributions | Pre-tax contributions lower taxable income | Up to $22,500/year (2025 limit) |

| Student Loan Interest Deduction | Deduct up to $2,500 interest paid | Up to $2,500/year |

| Earned Income Tax Credit | Credit for low-to-moderate income earners | Up to $6,935 (2025 max) |

| Health Savings Account | Tax-free medical savings | Varies by contribution |

Leveraging Community and Peer Support for Financial Growth

Millennials thrive in communities. Leveraging peer groups and community resources can accelerate financial learning and accountability.

Ways to Leverage Community

- Join Financial Groups: Online forums, Facebook groups, or local meetups focused on personal finance.

- Accountability Partners: Pair up with friends or colleagues to set and track financial goals.

- Attend Workshops and Webinars: Many nonprofits and financial institutions offer free or low-cost education.

- Use Social Media Wisely: Follow credible financial educators and influencers for tips and motivation.

Case Study: Accountability Group Boosts Savings

A group of five friends committed to saving $500 each month and met weekly to share progress and challenges. After one year, collectively they saved over $30,000 and supported each other through setbacks.

Smart Use of Credit Without Falling Into Debt

Credit can be a useful financial tool if managed well. Millennials can hack their finances by using credit strategically.

Credit Hacks

- Use Credit Cards for Rewards, Not Debt: Pay balances in full monthly to avoid interest.

- Keep Credit Utilization Low: Aim for below 30% of credit limits to maintain good credit scores.

- Monitor Credit Reports Regularly: Detect errors or fraud early.

- Consider Credit Builder Loans: For those building credit from scratch, these loans help establish a positive history.

Emergency Fund Strategies Beyond the Basics

While many know the importance of emergency funds, millennials can optimize how they build and use these funds.

Advanced Emergency Fund Tips

- Tiered Emergency Fund:

- Tier 1: Immediate access savings for 1 month of expenses.

- Tier 2: Slightly less liquid accounts for 3-6 months.

- Tier 3: Longer-term savings or investments for 6-12 months.

- Automate Replenishment: If you dip into your fund, set up automatic transfers to rebuild quickly.

- Use High-Yield Savings Accounts: Earn better interest while keeping funds accessible.

Harnessing Side Hustles for Financial Freedom

Side hustles are more than just extra income; they can be a path to entrepreneurship and financial independence.

Popular Side Hustles for Millennials

- Freelancing (writing, design, programming)

- Selling handmade or digital products online

- Teaching or tutoring online

- Ridesharing or delivery services

- Investing in dividend stocks or rental properties

Tips for Side Hustle Success

- Choose hustles aligned with your skills and passions.

- Set clear income goals and track hours worked.

- Reinvest earnings into growing the side hustle or savings.

Planning for Big Financial Milestones

Millennials often face major milestones like buying a home, starting a family, or pursuing further education.

Hacks for Milestone Planning

- Home Buying: Save for down payment using dedicated accounts and research first-time buyer programs.

- Family Planning: Budget for childcare, education, and healthcare early.

- Education: Use 529 plans or employer tuition assistance programs.

How Personal Finance Hacks Millennials Use Can Help Achieve Financial Independence

One of the most powerful benefits of personal finance hacks millennials adopt is accelerating the journey toward financial independence. By implementing smart saving, budgeting, and investing strategies early, millennials can retire comfortably or pursue passions without financial stress.

Key Strategies Included in Personal Finance Hacks Millennials Use

- Prioritizing high-interest debt repayment

- Automating investments to harness compound growth

- Building multiple income streams

- Consistently tracking and adjusting budgets

Case Study: Jason’s Path to Early Retirement

Jason, 34, used personal finance hacks millennials recommend, like automating 15% of his income into a diversified portfolio and aggressively paying off credit card debt. Within 10 years, he accumulated enough assets to consider early retirement.

Personal Finance Hacks Millennials Should Use to Manage Student Loan Debt

Student loan debt is a significant burden for many millennials. Effective personal finance hacks millennials apply can reduce this debt faster and minimize interest paid.

Tips Included in These Hacks

- Refinancing loans at lower interest rates

- Making extra payments toward principal

- Utilizing employer student loan repayment benefits

- Applying for income-driven repayment plans when necessary

Impact of Extra Payments on Student Loan Repayment

| Extra Monthly Payment | Time Saved (Years) | Interest Saved ($) |

|---|---|---|

| $50 | 2 | $1,500 |

| $100 | 4 | $3,200 |

| $200 | 7 | $6,800 |

How Personal Finance Hacks Millennials Use to Build Emergency Funds Quickly

Creating an emergency fund is a foundational step in financial security. Many personal finance hacks millennials use focus on building this safety net efficiently.

Proven Hacks Include

- Setting up automatic transfers to a dedicated savings account

- Cutting discretionary spending temporarily to boost savings rate

- Using windfalls (tax refunds, bonuses) to fund emergency savings

- Keeping funds in high-yield savings accounts for better returns

Conclusion

By applying these personal finance hacks millennials trust, you can take control of your money, reduce stress, and build a secure financial future. Start small, stay consistent, and watch your wealth grow.