Crypto Cold Storage vs Hot Wallets: Ultimate Guide

Your Complete Guide to Secure Cryptocurrency Storage Methods

Crypto cold storage is one of the most important topics every cryptocurrency owner needs to understand. Whether you’re new to crypto or have been investing for years, choosing between cold storage and hot wallets can make the difference between keeping your digital assets safe or losing them forever. This complete guide will explain everything about crypto cold storage and hot wallets in simple, easy-to-understand language.

What Is Crypto Cold Storage?

Crypto cold storage refers to keeping your cryptocurrency offline, away from internet connections. Think of it like storing your money in a safe deposit box at a bank instead of carrying it in your wallet. When your crypto is in cold storage, hackers cannot access it through the internet because it’s completely disconnected from online networks.

The most common types of crypto cold storage include hardware wallets, paper wallets, and air-gapped computers. These methods keep your private keys (the secret codes that control your crypto) offline and secure from online threats.

What Are Hot Wallets?

Hot wallets are the opposite of crypto cold storage. These are cryptocurrency wallets that stay connected to the internet. Hot wallets include mobile apps, desktop software, and web-based wallets that you can access anytime through your phone or computer.

Hot wallets are like keeping cash in your regular wallet or purse. They’re convenient for daily use and quick transactions, but they’re also more vulnerable to theft because they’re always connected to the internet.

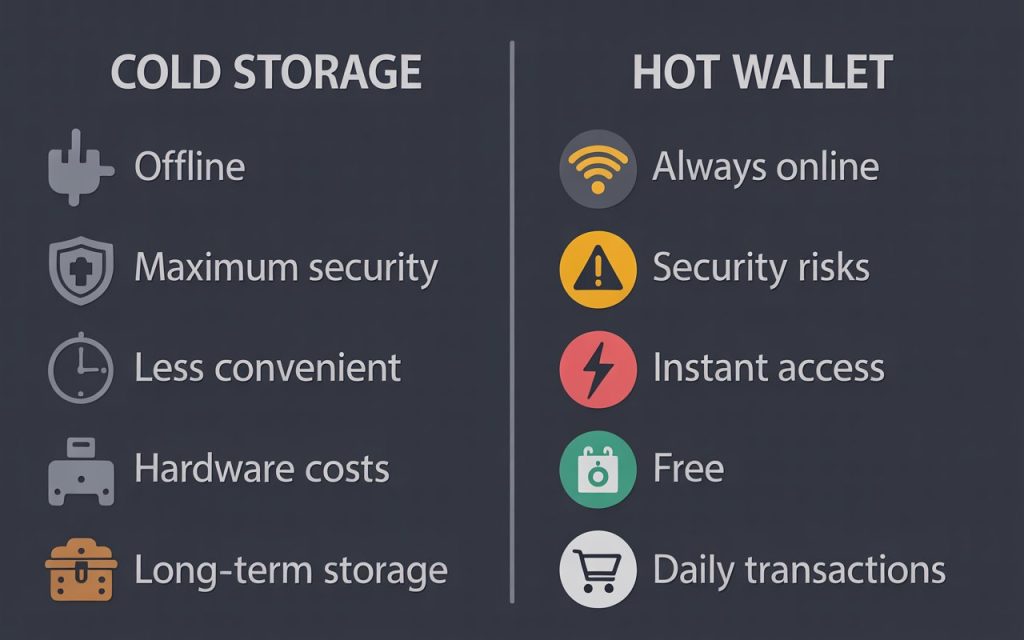

The Main Differences Between Crypto Cold Storage and Hot Wallets

Understanding the key differences between crypto cold storage and hot wallets will help you make the right choice for your needs:

Internet Connection

- Cold Storage: Completely offline, no internet connection

- Hot Wallets: Always connected to the internet

Security Level

- Cold Storage: Maximum security, nearly impossible to hack

- Hot Wallets: Lower security, vulnerable to online attacks

Convenience

- Cold Storage: Less convenient, requires more steps for transactions

- Hot Wallets: Very convenient, instant access and transactions

Cost

- Cold Storage: Usually costs money to buy hardware

- Hot Wallets: Often free to download and use

Best Use Cases

- Cold Storage: Long-term storage of large amounts

- Hot Wallets: Daily transactions and small amounts

Crypto Cold Storage: The Pros

Crypto cold storage offers several important advantages that make it the preferred choice for serious cryptocurrency investors:

Maximum Security Protection

The biggest advantage of crypto cold storage is its superior security. Since your private keys never touch the internet, hackers cannot steal them through online attacks. This makes cold storage the safest way to protect large amounts of cryptocurrency.

Even if your computer gets infected with malware or viruses, your crypto in cold storage remains completely safe. The offline nature of crypto cold storage creates an impenetrable barrier against cybercriminals.

Protection from Exchange Hacks

Cryptocurrency exchanges get hacked regularly, and users lose millions of dollars every year. When you use crypto cold storage, your funds are not stored on exchanges, so you’re protected from these devastating hacks.

History shows us that even the biggest and most trusted exchanges can be compromised. By using cold storage, you take control of your own security instead of relying on third parties.

Long-term Investment Security

Crypto cold storage is perfect for long-term investors who plan to hold their cryptocurrency for months or years. You can store your crypto safely and not worry about daily security threats or market volatility affecting your storage method.

Many successful crypto investors use cold storage as their primary method for holding large amounts of cryptocurrency. This strategy, often called “HODLing,” has proven effective for building long-term wealth.

Complete Control Over Your Assets

With crypto cold storage, you have complete control over your private keys and cryptocurrency. You don’t need to trust banks, exchanges, or other third parties to keep your money safe. This independence is one of the core principles of cryptocurrency.

The phrase “not your keys, not your crypto” perfectly explains why cold storage is so important. When you control your private keys through cold storage, you truly own your cryptocurrency.

Protection from Government Seizure

Crypto cold storage can protect your assets from government seizure or freezing. Since your crypto is stored offline and only you have access to the private keys, authorities cannot easily confiscate your digital assets.

This protection is especially valuable in countries with unstable governments or strict financial controls. Cold storage gives you financial sovereignty that traditional banking cannot provide.

Crypto Cold Storage: The Cons

While crypto cold storage offers excellent security, it also has some disadvantages you should consider:

Less Convenient for Daily Use

The main drawback of crypto cold storage is inconvenience. Every time you want to send cryptocurrency, you need to connect your cold storage device, enter passwords, and confirm transactions manually. This process takes much longer than using hot wallets.

For people who trade frequently or use crypto for daily purchases, cold storage can be frustratingly slow. The extra security comes at the cost of convenience and speed.

Higher Upfront Costs

Quality crypto cold storage devices cost money. Hardware wallets typically range from $50 to $200, which might seem expensive for beginners with small amounts of cryptocurrency.

However, this cost is usually worth it when you consider the value of the crypto you’re protecting. Think of it as insurance for your digital assets.

Risk of Physical Loss or Damage

Since crypto cold storage involves physical devices, you can lose or damage them. If your hardware wallet breaks, gets stolen, or is destroyed in a fire or flood, you could lose access to your cryptocurrency.

This risk makes it crucial to create proper backups of your recovery phrases and store them in multiple secure locations.

Technical Learning Curve

Crypto cold storage requires more technical knowledge than hot wallets. You need to understand concepts like private keys, recovery phrases, and proper backup procedures.

New users might find cold storage intimidating at first, but the learning investment pays off in improved security and peace of mind.

Potential for User Error

With crypto cold storage, you’re responsible for everything. If you forget your password, lose your recovery phrase, or make mistakes during setup, you could permanently lose access to your cryptocurrency.

This responsibility can be stressful for some users who prefer the convenience of having customer support available to help with problems.

Hot Wallets: The Pros

Hot wallets offer several advantages that make them popular among cryptocurrency users:

Instant Access and Convenience

Hot wallets provide immediate access to your cryptocurrency. You can send, receive, and trade crypto instantly without any delays or complicated procedures. This convenience makes hot wallets perfect for active traders and people who use crypto regularly.

The user-friendly interfaces of most hot wallets make them easy to use, even for complete beginners. You can start using crypto within minutes of downloading a hot wallet app.

Free to Use

Most hot wallets are completely free to download and use. This makes them accessible to everyone, regardless of budget. You don’t need to invest in expensive hardware to start using cryptocurrency.

The free nature of hot wallets removes barriers to entry and helps more people get started with cryptocurrency.

Perfect for Small Amounts

Hot wallets are ideal for storing small amounts of cryptocurrency that you use for daily transactions. Just like you wouldn’t carry thousands of dollars in cash, you shouldn’t store large amounts in hot wallets.

For spending money and small investments, hot wallets provide the perfect balance of convenience and functionality.

Easy Integration with Services

Hot wallets integrate seamlessly with cryptocurrency exchanges, DeFi platforms, and other crypto services. This integration makes it easy to trade, stake, or use your crypto in various applications.

Many hot wallets also support multiple cryptocurrencies, allowing you to manage different digital assets in one convenient location.

Regular Updates and Support

Hot wallet developers regularly update their software to add new features and fix security issues. Most also provide customer support to help users with problems or questions.

This ongoing support and development makes hot wallets more user-friendly and reliable over time.

Hot Wallets: The Cons

Despite their convenience, hot wallets have significant disadvantages:

Vulnerability to Hacking

The biggest risk of hot wallets is their vulnerability to hacking and cyber attacks. Since they’re always connected to the internet, malicious actors can potentially access your private keys and steal your cryptocurrency.

Hackers use various methods to attack hot wallets, including malware, phishing attacks, and exploiting software vulnerabilities. These risks make hot wallets unsuitable for storing large amounts of cryptocurrency.

Dependence on Third Parties

Many hot wallets, especially web-based ones, require you to trust third-party companies with your private keys. If these companies get hacked, go out of business, or act maliciously, you could lose your cryptocurrency.

This dependence on others goes against the decentralized nature of cryptocurrency and puts your assets at risk.

Risk of Exchange Failures

Hot wallets on cryptocurrency exchanges are particularly risky. When exchanges fail, get hacked, or freeze accounts, users often lose their funds permanently. History is full of examples of major exchanges collapsing and taking users’ money with them.

The convenience of keeping crypto on exchanges comes with significant risks that many users don’t fully understand.

Susceptible to Malware

Hot wallets on computers and smartphones can be compromised by malware and viruses. If your device gets infected, hackers might be able to access your wallet and steal your cryptocurrency.

This risk is especially high for users who don’t maintain good cybersecurity practices or use outdated software.

Limited Control

With some hot wallets, especially custodial ones, you don’t have full control over your private keys. This means you’re trusting someone else to keep your cryptocurrency safe, which defeats the purpose of decentralized digital money.

Types of Crypto Cold Storage

Crypto cold storage comes in several different forms, each with its own advantages and use cases:

Hardware Wallets

Hardware wallets are the most popular form of crypto cold storage. These are small, USB-like devices that store your private keys offline. Popular brands include Ledger, Trezor, and KeepKey.

Hardware wallets offer the best combination of security and usability. They’re offline when not in use but can connect to your computer when you need to make transactions.

Paper Wallets

Paper wallets involve printing your private keys and public addresses on paper and storing them securely offline. While this method is completely offline, it’s also the most vulnerable to physical damage and loss.

Paper wallets require careful handling and storage to prevent damage from water, fire, or deterioration over time.

Air-Gapped Computers

An air-gapped computer is one that has never been connected to the internet. You can use these computers to generate and store private keys in complete isolation from online threats.

This method requires significant technical knowledge and is usually only used by advanced users or institutions with large amounts of cryptocurrency.

Steel Wallets

Steel wallets involve engraving or stamping your recovery phrase onto metal plates. This method provides excellent protection against fire, water, and other physical damage that could destroy paper backups.

Steel wallets are often used as backup storage for hardware wallet recovery phrases.

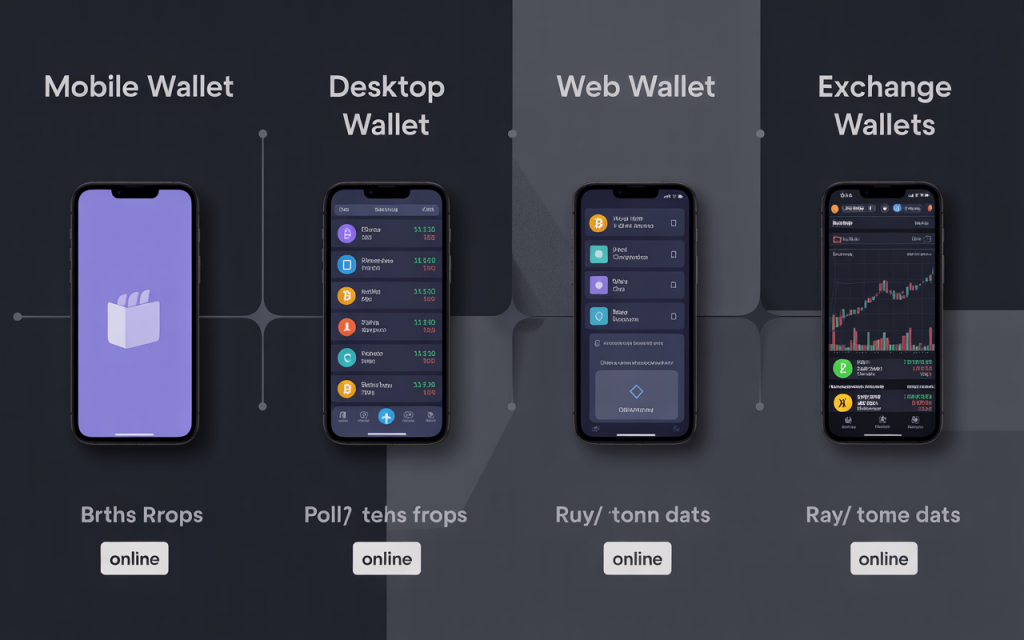

Types of Hot Wallets

Hot wallets come in various forms to suit different needs and preferences:

Mobile Wallets

Mobile wallet apps run on smartphones and tablets. They’re convenient for daily use and often include features like QR code scanning for easy transactions. Popular mobile wallets include Trust Wallet, Coinbase Wallet, and MetaMask Mobile.

Desktop Wallets

Desktop wallets are software programs that run on computers. They often provide more features than mobile wallets and can be more secure if your computer is well-protected. Examples include Exodus, Electrum, and Atomic Wallet.

Web Wallets

Web wallets run in internet browsers and can be accessed from any device with internet connection. While convenient, they’re also the least secure type of hot wallet. Examples include MetaMask browser extension and MyEtherWallet.

Exchange Wallets

Exchange wallets are provided by cryptocurrency exchanges for storing funds while trading. While convenient for active trading, they’re also the riskiest type of hot wallet due to frequent exchange hacks.

Choosing Between Crypto Cold Storage and Hot Wallets

The choice between crypto cold storage and hot wallets depends on several factors:

Amount of Cryptocurrency

If you own large amounts of cryptocurrency, crypto cold storage is essential. The general rule is to keep only small amounts in hot wallets for daily use and store the majority in cold storage.

Most experts recommend keeping no more than 5-10% of your total crypto holdings in hot wallets.

Frequency of Use

If you trade frequently or use crypto for daily purchases, you’ll need hot wallets for convenience. However, you should still use crypto cold storage for your long-term holdings.

Active traders often use a combination of both storage methods to balance security and convenience.

Technical Expertise

Crypto cold storage requires more technical knowledge than hot wallets. If you’re not comfortable with technology, you might want to start with hot wallets and gradually learn about cold storage.

However, the learning investment is worth it for the improved security that cold storage provides.

Risk Tolerance

Conservative investors who prioritize security should focus on crypto cold storage. Risk-tolerant users who value convenience might be comfortable with hot wallets for larger amounts.

Your risk tolerance should guide your storage strategy and help you find the right balance.

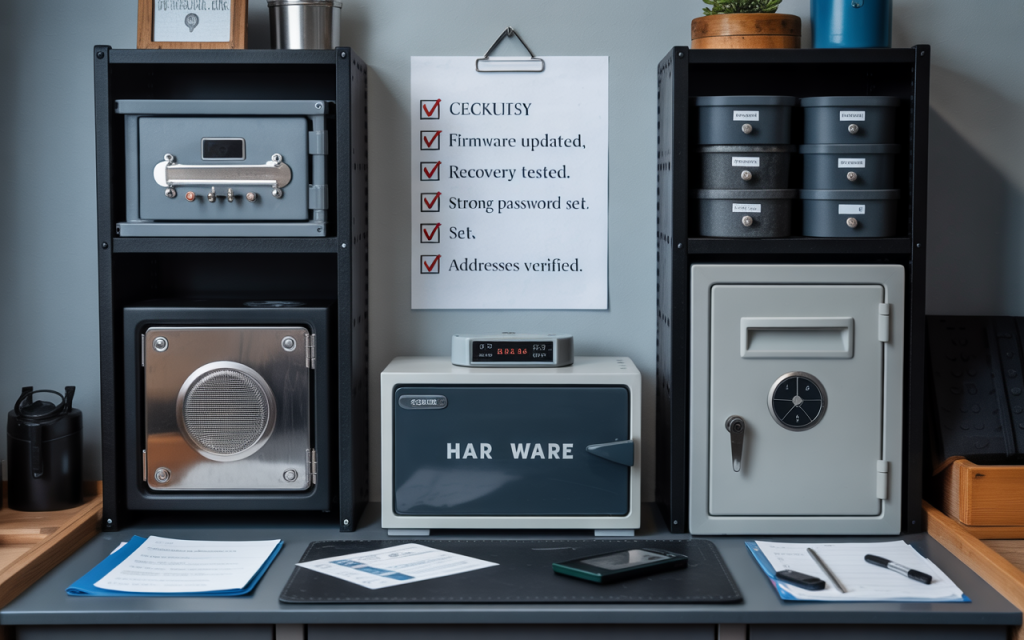

Best Practices for Crypto Cold Storage

To maximize the benefits of crypto cold storage, follow these best practices:

Create Multiple Backups

Always create multiple backups of your recovery phrases and store them in different secure locations. This protects you from losing access if one backup is damaged or lost.

Consider using fire-resistant and waterproof storage solutions for your backups.

Test Your Recovery Process

Before storing large amounts in crypto cold storage, test your recovery process with small amounts. Make sure you can successfully restore your wallet using your backup phrases.

This testing helps you identify and fix any problems before they become costly mistakes.

Keep Firmware Updated

Regularly update your hardware wallet firmware to ensure you have the latest security features and bug fixes. Most manufacturers release updates periodically to improve security and functionality.

Use Strong Passwords

Protect your crypto cold storage devices with strong, unique passwords. Avoid using passwords that you use for other accounts or services.

Consider using a password manager to generate and store strong passwords securely.

Verify Addresses Carefully

Always double-check receiving addresses before sending cryptocurrency to your cold storage. Malware can sometimes change addresses in your clipboard, causing you to send funds to hackers.

Use the address verification features on your hardware wallet to confirm addresses are correct.

Best Practices for Hot Wallets

If you use hot wallets, follow these security practices:

Use Reputable Wallets

Only use hot wallets from reputable developers with good security track records. Research wallets thoroughly before trusting them with your cryptocurrency.

Avoid new or unknown wallets that haven’t been tested by the community.

Enable All Security Features

Turn on all available security features, including two-factor authentication, biometric locks, and transaction confirmations. These features add layers of protection to your hot wallet.

Keep Software Updated

Regularly update your hot wallet software to ensure you have the latest security patches and features. Enable automatic updates when possible.

Use Separate Devices

Consider using a dedicated device for your hot wallet that you don’t use for other internet activities. This reduces the risk of malware infection.

Monitor Transactions Regularly

Check your hot wallet transactions regularly to identify any unauthorized activity quickly. Set up notifications for all transactions when possible.

The Future of Crypto Cold Storage

Crypto cold storage technology continues to evolve and improve. Future developments may include:

Improved User Interfaces

Hardware wallet manufacturers are working to make crypto cold storage more user-friendly without compromising security. Future devices may feature better screens, easier setup processes, and more intuitive interfaces.

Multi-Signature Support

Advanced crypto cold storage solutions are adding multi-signature support, which requires multiple signatures to authorize transactions. This adds an extra layer of security for institutional users and high-value storage.

Integration with DeFi

Developers are working on ways to use crypto cold storage with decentralized finance (DeFi) applications while maintaining security. This could allow cold storage users to participate in DeFi without exposing their private keys.

Biometric Authentication

Future crypto cold storage devices may include biometric authentication like fingerprint or facial recognition to improve security and convenience.

Common Mistakes to Avoid

When using crypto cold storage or hot wallets, avoid these common mistakes:

Storing Recovery Phrases Digitally

Never store your recovery phrases in digital format, including photos, emails, or cloud storage. These digital copies can be hacked or accidentally shared.

Using Untested Wallets

Don’t trust new or untested wallets with significant amounts of cryptocurrency. Stick to well-established wallets with proven security records.

Ignoring Security Updates

Always install security updates promptly for both crypto cold storage devices and hot wallets. Delayed updates can leave you vulnerable to known security issues.

Mixing Storage Methods Incorrectly

Don’t use the same recovery phrase for both cold storage and hot wallets. This defeats the purpose of cold storage security.

Skipping Backup Verification

Always verify that your backups work before relying on them. Many people discover their backups are incomplete or incorrect only when they need them most.

Conclusion

Crypto cold storage and hot wallets each serve important purposes in cryptocurrency management. Cold storage provides maximum security for long-term holdings, while hot wallets offer convenience for daily use and small amounts. Whether you’re just starting with cryptocurrency or you’re a seasoned investor, proper storage is crucial for protecting your digital assets. Make security a priority, and your future self will thank you for the extra effort you put into keeping your cryptocurrency safe.