Investing in a Volatile Market: Risk or Opportunity?

Investing in a volatile market is often seen as a double-edged sword. Volatility refers to the rapid and unpredictable price fluctuations in financial markets. While volatility can increase the risk of losses, it can also present unique opportunities for savvy investors.

What is Volatility in the Market?

Volatility measures how much and how quickly asset prices change over a short period. High volatility means prices swing widely, while low volatility indicates steadier prices. Market volatility can be caused by many factors including economic data releases, geopolitical events, interest rate changes, pandemics, and investor sentiment shifts.

Understanding Market Volatility in Depth

Investing in a volatile market means navigating unpredictable price swings that can be both intimidating and rewarding. Volatility is measured by indicators like the VIX (Volatility Index), which spikes during uncertainty. Common causes include economic shocks, political instability, global crises, and sudden changes in investor sentiment.

“Volatility is the price you pay for the opportunity to earn higher returns.” — Warren Buffett

Types of Volatility

- Historical Volatility: Measures past price changes over a set period.

- Implied Volatility: Predicts future volatility based on options prices.

- Market vs. Asset Volatility: Some sectors (like tech) are more volatile than others (utilities).

Why Does Volatility Matter to Investors?

Volatility affects both the risk and potential reward of investments. High volatility can lead to larger gains but also bigger losses. For investors, this means:

- Increased risk: Prices can drop suddenly, causing losses.

- Increased opportunity: Sharp price movements can create chances to buy undervalued assets or profit from price swings.

Is Investing in a Volatile Market Risk or Opportunity?

The answer depends on the investor’s approach, risk tolerance, and strategy. Volatility is neither inherently good nor bad but a condition that can be managed to reduce risk and capitalize on opportunities.

Key Features of Investing in a Volatile Market

- Rapid price fluctuations: Prices can change quickly and unpredictably.

- Emotional challenges: Volatility can trigger fear and impulsive decisions.

- Diverse asset behavior: Different assets react differently to volatility.

- Potential for gains and losses: Volatility increases both upside and downside potential.

- Importance of discipline: Staying focused on long-term goals is crucial.

How Volatility Impacts Different Asset Classes

| Asset Class | Typical Volatility | Example Behavior in Crisis |

|---|---|---|

| Stocks | High | Sharp drops and rebounds |

| Bonds | Low to Medium | Prices rise as safe haven |

| Commodities | High | Oil/gold spike or crash |

| Real Estate | Medium | Slower, less dramatic moves |

| Cryptocurrencies | Very High | Extreme price swings |

Sector Sensitivity

- Technology and Emerging Markets: Highly sensitive to global news.

- Consumer Staples and Utilities: More stable, less affected by volatility.

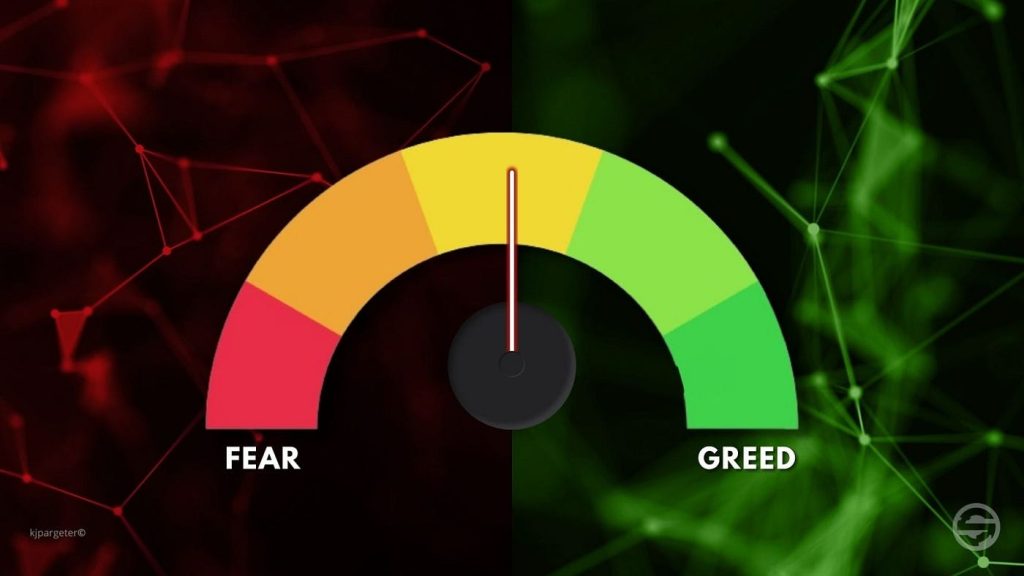

Psychological Aspects of Investing in a Volatile Market

- Herd Mentality: Following the crowd often results in buying high and selling low.

- Confirmation Bias: Seeking information that supports existing beliefs can cloud judgment.

- Fear and Greed: Emotional reactions can lead to poor decisions.

Managing Emotions

- Set clear investment goals.

- Use automated investing tools to remove emotion.

- Take breaks from market news during turbulent times.

Advanced Strategies for Volatile Markets

Hedging

- Options: Use puts to protect against downside.

- Inverse ETFs: Profit when markets fall.

- Gold and Safe Havens: Allocate a portion to assets that rise in crises.

Tactical Rebalancing

- Review and adjust your portfolio more frequently.

- Shift allocations to defensive sectors during high volatility.

Value Investing

- Seek undervalued stocks with strong fundamentals.

- Focus on companies with healthy balance sheets and cash flows.

Growth vs. Value in Volatile Times

| Strategy | Strength in Volatility | Weakness in Volatility |

|---|---|---|

| Growth | Can rebound quickly | Prone to sharp drops |

| Value | More stable | May lag in recoveries |

Visual: Market Volatility Example

textYear S&P 500 Return VIX Average

2017 +19% 11.1

2018 -6% 16.6

2020 +16% 29.2

2022 -19% 25.6

Notice how higher VIX years often coincide with big market moves.

Strategies for Investing in a Volatile Market

1. Stay the Course with a Diversified Portfolio

Diversification spreads investments across asset classes (stocks, bonds, real estate, commodities) and sectors to reduce risk. Since not all assets move in the same direction at the same time, diversification cushions the impact of volatility.

2. Use Dollar-Cost Averaging

Investing a fixed amount regularly helps average out purchase prices over time, reducing the risk of investing a lump sum at a market peak.

3. Adapt Your Trading Strategy

Dynamic asset allocation and tactical adjustments based on market conditions can help reduce losses. Using stop-loss orders and position sizing helps control risk during volatile periods.

4. Incorporate Protective Assets

Adding bonds, gold, or cash reserves can stabilize returns during downturns. Alternative assets like commodities or REITs also provide diversification benefits.

5. Avoid Emotional Decisions

Selling during market drops locks in losses. Maintaining a long-term perspective and sticking to a financial plan helps avoid reactionary moves.

6. Consider Volatility-Specific Instruments

Experienced investors may use options, VIX futures, or volatility ETFs to hedge or profit from volatility itself, though these require expertise.

Pros and Cons of Investing in a Volatile Market

| Pros | Cons |

|---|---|

| Larger potential for gains due to price swings | Increased risk of significant losses |

| More frequent trading opportunities | Emotional stress and impulsive decision-making |

| Learning opportunities for strategy development | Higher trading costs (wider spreads, slippage) |

| Dynamic trading environment with liquidity | Increased complexity and need for discipline |

Case Studies: Investing in Volatile Markets

Case Study 1: Vanguard’s Diversification Success

Vanguard’s Total Stock Market Index Fund spreads investments broadly, reducing risk during volatility. This approach cushioned investors during market swings and helped capture recovery gains.

Case Study 2: Long-Term Capital Management’s Hedging with Options

LTCM used options and volatility arbitrage to manage risk and profit from market swings, demonstrating advanced volatility management.

Case Study 3: Individual Investor’s Diversification Strategy

Mr. Smith diversified across stocks, bonds, and commodities and included volatility-based funds, successfully protecting his portfolio during downturns.

Case Study 4: COVID-19 Market Crash and Recovery

In March 2020, markets plunged due to the pandemic. Investors who stayed invested or bought undervalued stocks during the dip saw significant gains during the rapid recovery.

Case Study 5: Balanced vs. Bond-Only Investor (2007-2017)

A balanced investor who stayed invested in stocks and bonds outperformed a bond-only investor who exited stocks before the 2008 crash, benefiting from the recovery and ongoing contributions.

Case Study 6: Tactical Asset Allocation in 2022

Investors who adjusted asset allocation dynamically during 2022’s inflation-driven volatility managed to reduce losses compared to static portfolios.

Case Study 7: Trading VIX Futures in 2018

A trader profited by exploiting the backwardation in VIX futures during a volatility spike, showing how volatility trading can generate returns regardless of market direction.

Case Study 8: Use of Stop-Losses and Position Sizing

Traders who used wider stop-losses and smaller position sizes during volatile periods avoided premature exits and large losses.

Tips for Investing in Volatile Markets

- Know your risk tolerance and reassess it regularly.

- Stick to your long-term financial plan.

- Diversify widely across asset classes and geographies.

- Invest regularly using dollar-cost averaging.

- Avoid trying to time the market.

- Consider professional advice if volatility causes stress.

- Use protective assets to stabilize your portfolio.

- Educate yourself about volatility instruments if trading actively.

Frequently Asked Questions (FAQs)

- What is market volatility?

Market volatility is the degree of variation in asset prices over time, reflecting uncertainty and rapid price changes. - Is volatility bad for my investments?

Not necessarily. Volatility can create buying opportunities and is normal in markets. - How often do market corrections happen?

Market corrections (10%+ declines) occur roughly every 1-2 years. - Should I sell when the market drops?

Selling during downturns can lock in losses. Staying invested is usually better for long-term growth. - How can I reduce risk in volatile markets?

Diversify your portfolio, rebalance regularly, and maintain a long-term focus. - What is dollar-cost averaging?

Investing a fixed amount regularly to average out purchase prices over time. - Can I profit from volatility itself?

Yes, through options, VIX futures, and volatility ETFs, but these require expertise. - What role do bonds play in volatile markets?

Bonds often provide stability and offset equity market swings. - How do I manage emotional stress during volatility?

Stick to your plan, avoid impulsive decisions, and consider professional guidance. - Is timing the market effective?

Timing the market is very difficult and often leads to missed gains.

This comprehensive guide aims to empower you with knowledge and practical advice on investing in a volatile market. By understanding volatility, employing proven strategies, and learning from real-world examples, you can navigate uncertainty with confidence and potentially turn risk into opportunity.

Conclusion

Investing in a volatile market is challenging but also offers unique opportunities for growth. By understanding volatility, managing risk, and staying disciplined, investors can turn uncertainty into advantage. Remember, volatility is a natural part of investing and can be navigated successfully with the right strategies and mindset.