The Real Cost of Subscription Culture in 2025

The real cost of subscription culture in 2025 is more complex than just a monthly bill. Subscriptions now shape how we access entertainment, news, groceries, software, fitness, transport, and even clothing. While they offer convenience and flexibility, their hidden costs—financial, psychological, and social—are often underestimated.

What is Subscription Culture?

The real cost of subscription culture in 2025 begins with understanding what subscription culture is. It means paying a regular fee — monthly, yearly — for a product or service. Instead of owning, you “rent” access. This could be Netflix, Spotify, Apple Music, meal kits, software, cloud storage, beauty boxes — the list grows daily.

The Rise of Subscription Culture

Subscription culture grew fast over the last decade. Companies love it because:

- They get regular, predictable income.

- Customers stay longer because canceling feels hard.

- It’s easy to add “small” charges that add up over time.

Why Subscription Culture Feels Convenient

People love subscriptions because:

- You get instant access anytime.

- No big upfront payment.

- Cancel anytime (in theory).

- No need to “own” physical stuff.

- It feels like freedom — but it’s not always cheaper.

Key Features of Subscription Culture in 2025

- Ubiquity: Subscriptions are everywhere—media, retail, food, transport, and more.

- Personalization: AI-driven recommendations and tailored plans are now the norm.

- Flexibility: Pause, resume, or switch tiers with ease.

- Sustainability: Eco-friendly options and digital alternatives are growing.

- Emotional Engagement: Brands focus on storytelling and connection, not just transactions.

- Regulation: New rules demand transparency and easy cancellation.

- Bundling: Services are increasingly packaged together for perceived value.

The Real Cost of Subscription Culture in 2025: Overview

The real cost of subscription culture in 2025 goes beyond the price tag. It includes:

- Direct financial costs: Monthly, annual, and hidden fees.

- Cognitive load: Managing multiple accounts, remembering renewals, and tracking usage.

- Emotional strain: Anxiety from subscription overload and FOMO (fear of missing out).

- Social effects: Isolation from digital-only experiences or exclusion due to paywalls.

- Environmental impact: Packaging waste and digital carbon footprints.

Financial Impact: What Are You Really Paying?

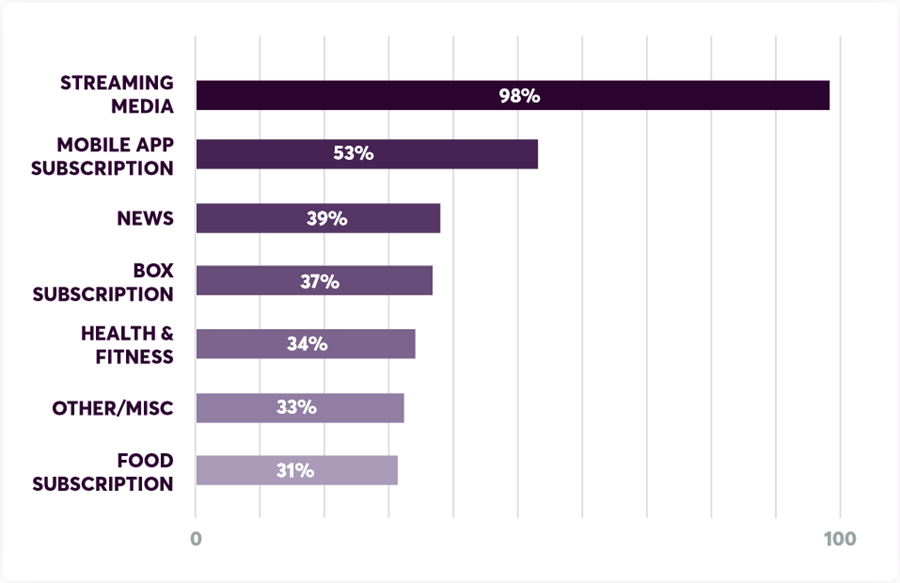

Subscription Spending Breakdown

| Category | Average Monthly Spend (2025) | Typical Services Included |

|---|---|---|

| Streaming Media | $40–$60 | Netflix, Spotify, Disney+, etc. |

| Food & Grocery | $30–$100 | Meal kits, grocery delivery |

| Software & Apps | $20–$50 | Office, design, productivity |

| Fitness & Health | $10–$50 | Online classes, gym memberships |

| Retail & Fashion | $20–$80 | Clothing boxes, accessories |

| Transport | $30–$100 | Ride-share, e-scooters, car clubs |

| News & Learning | $10–$30 | News sites, e-learning |

| Utilities | $10–$50 | Internet, cloud storage |

Note: Many users subscribe to multiple services in each category, often underestimating their total monthly spend.

Hidden Costs

- Unused subscriptions: Up to 70% of consumers pay for services they rarely use.

- Annual renewals: Lump-sum charges can catch you off guard.

- Price increases: Subtle hikes often go unnoticed until it’s too late.

- Bundled services: Paying for features you don’t use.

Budgeting for Subscriptions

- Use the 50/30/20 rule: Allocate part of your “wants” budget to subscriptions.

- Set a hard cap: For example, no more than $200/month on non-essentials.

Emotional and Psychological Costs

- Decision fatigue: Too many choices lead to stress and confusion.

- Subscription overload: Managing dozens of services causes anxiety and guilt.

- FOMO: Marketing tactics create fear of missing out on “exclusive” content.

- Sunk cost fallacy: People keep paying to justify past spending, even when not using the service.

- Social isolation: Digital subscriptions can reduce real-world interactions.

Social and Lifestyle Effects

- Belonging and identity: Subscriptions are now part of personal identity and social circles.

- Exclusion: Paywalls and premium tiers can create social divides.

- Convenience vs. control: Easy access can lead to overconsumption and loss of control.

Industry Trends and Innovations

- AI-powered personalization: Dynamic pricing, content curation, and usage insights.

- Flexible models: Pause, downgrade, or switch plans anytime.

- Sustainability: Eco-friendly packaging and digital alternatives.

- Bundling: Combining services for perceived savings, but sometimes leading to feature bloat.

- Regulation: Crackdown on “dark patterns,” hidden fees, and difficult cancellations.

- Emerging markets: Growth in Africa, Asia-Pacific, and Latin America with localized offerings.

Pros and Cons Table

| Pros | Cons |

|---|---|

| Convenience and time-saving | Accumulated costs can exceed expectations |

| Access to premium/exclusive content | Unused subscriptions drain money |

| Flexibility to pause, cancel, or switch | Overload causes stress and decision fatigue |

| Personalized experiences and recommendations | Difficult cancellation and hidden fees |

| Regular updates and new features | Social isolation and reduced real-world contact |

| Predictable budgeting for recurring needs | Environmental impact from packaging and data use |

Case Studies: Subscription Culture in Action

Case Study 1: The Streaming Stack

Sarah subscribes to five streaming platforms. She only watches two regularly but pays $60/month. After reviewing her usage, she cancels three, saving $36/month.

Case Study 2: The Forgotten Fitness App

James signed up for a fitness app in January. By March, he stopped using it but forgot to cancel. He paid $120 over the year for nothing.

Case Study 3: The Bundled Trap

A family subscribes to a bundled package (music, TV, cloud storage). They only use TV, but the bundle is cheaper than buying TV alone. They keep the bundle but feel wasteful.

Case Study 4: The Annual Surprise

Maria pays for a yearly meal kit. She forgets the renewal and is hit with a $600 charge, disrupting her monthly budget.

Case Study 5: Subscription Overload and Burnout

David manages 12 subscriptions. Tracking payments and usage becomes overwhelming, causing anxiety and guilt.

Case Study 6: The Churn-and-Return Cycle

Lily cancels her streaming service during exam season. She rejoins three months later when new shows are released, a behavior now common among young adults.

Case Study 7: The Eco-Conscious Consumer

Adebayo switches to a meal kit with eco-friendly packaging. He pays a premium but feels better about his environmental impact.

Case Study 8: The Regulatory Wake-Up Call

After new regulations, a major music service makes cancellation one-click. Churn rises, but customer trust and brand loyalty improve.

Tips to Manage Subscription Spending

- Audit regularly: Review all subscriptions every 3–6 months.

- Use budgeting apps: Tag and track recurring payments.

- Set reminders: For annual renewals and price changes.

- Cap your spend: Decide a maximum monthly amount for non-essentials.

- Prioritize value: Keep only subscriptions you use and enjoy.

- Pause or downgrade: Instead of canceling, reduce your plan if available.

- Watch for price hikes: Read all “terms/pricing update” emails.

- Bundle wisely: Only choose bundles if you use most included services.

- Embrace free trials: Test before committing and set reminders to cancel if not satisfied.

- Use prepaid cards: Limit spending by using a prepaid card for discretionary subscriptions.

Frequently Asked Questions (FAQ)

- What is subscription culture?

A lifestyle where people access products and services through recurring payments instead of one-time purchases. - Why do people overspend on subscriptions?

Convenience, FOMO, and forgetting to cancel unused services. - How can I track all my subscriptions?

Use budgeting apps or create a spreadsheet to list and monitor all recurring payments. - Are bundled subscriptions always a good deal?

Not always. Only bundle if you use most of the included services. - What are “dark patterns” in subscriptions?

Design tricks that make it hard to cancel or spot extra charges. - How do I avoid subscription overload?

Audit your subscriptions, set a spending cap, and cancel unused services regularly. - What should I do if a subscription price increases?

Review if it’s still worth it. Cancel or downgrade if not. - Can subscriptions hurt my mental health?

Yes, managing too many can cause stress, anxiety, and decision fatigue. - Are subscriptions better than one-time purchases?

It depends. Subscriptions offer convenience and flexibility but can cost more over time if not managed well. - How is regulation changing subscription culture?

New rules require clear pricing, easy cancellations, and more transparency for consumers.

Conclusion

The real cost of subscription culture in 2025 is more than just money. It includes emotional, social, and environmental factors that can affect your well-being and financial security. By staying informed, auditing your subscriptions, and prioritizing value, you can enjoy the benefits of subscription culture while avoiding its hidden pitfalls.