Crypto Scams: Are Crypto Scams Getting Smarter? Here’s How to Spot Them

Crypto scams are getting smarter, more creative, and harder to detect than ever before. In 2025, the world of cryptocurrency is booming, attracting millions of new users who are eager to invest, trade, or simply explore digital assets. But as the crypto market grows, so does the sophistication of cybercriminals. Today’s crypto scams go far beyond the old tricks of phishing emails or fake websites. Scammers now use artificial intelligence, deepfake videos, social engineering, and even long-term psychological manipulation to target unsuspecting victims.

The rise of social media and instant messaging has made it easy for fraudsters to reach people all over the world, often using stolen identities or hacked accounts to appear trustworthy.

Crypto scams are no longer just about stealing passwords—they can involve fake investment platforms, romance scams that build trust over months, and even complex schemes that use multiple channels to pressure victims into sending money.

These scams are designed to trick both beginners and experienced traders, making it crucial for everyone in the crypto space to stay alert and informed.

Understanding how crypto scams operate, why they are getting smarter, and what new tactics you might face is essential for protecting your funds and your personal information. In this article, you’ll discover the latest methods scammers use, real-world examples of how people have been tricked, and practical steps you can take to spot and avoid the most advanced crypto scams in 2025

Why They’re Getting Smarter

Crypto scams are not what they used to be. Here’s why they’re evolving so quickly:

1. Advanced Technology

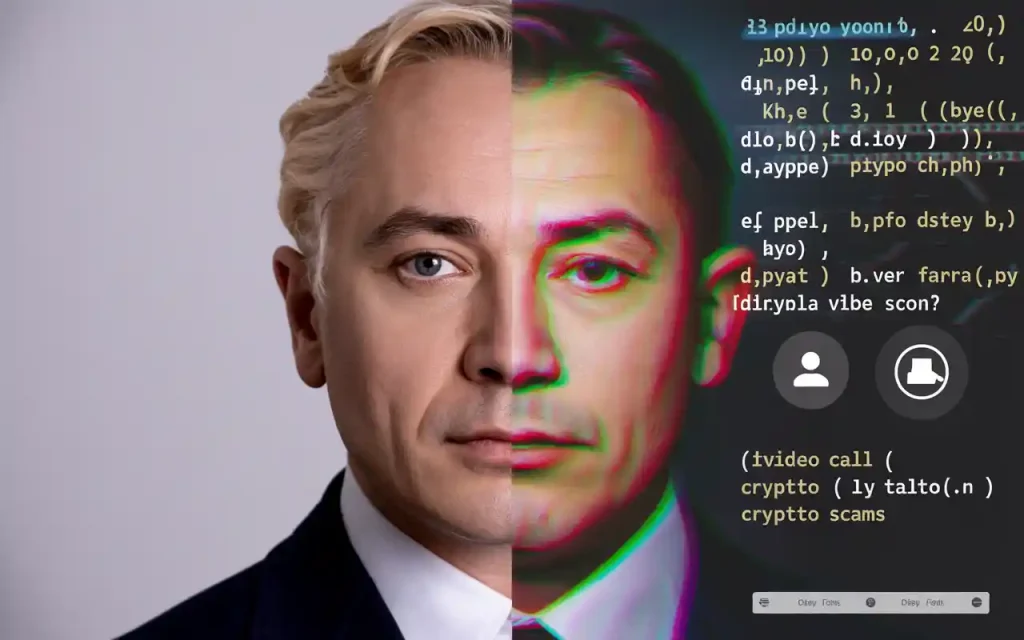

- AI and Deepfakes: Scammers use artificial intelligence to create fake videos, audio messages, and chatbots. These tools can impersonate celebrities, company leaders, or even your friends. For example, you might get a video call from someone who looks and sounds exactly like your boss, asking for a crypto payment.

- Automated Bots: Bots can send thousands of scam messages across social media, email, and messaging apps in seconds. This increases the reach and speed of scams.

- Data Mining: Scammers collect personal information from social media and data leaks to make their messages more convincing and personal.

2. Social Engineering

- Long-Term Trust Building: Some scammers build relationships over weeks or months. They might start with friendly chats on social media or dating apps, slowly gaining your trust before introducing a fake investment opportunity.

- Emotional Manipulation: Fraudsters use your emotions—fear, excitement, or urgency—to push you into making quick decisions. They might claim you’re about to miss out on a huge opportunity or that your funds are at risk.

3. Global Crime Networks

- Professional Scam Groups: Organized crime groups now run many crypto scams. They share resources, software, and “scam kits” that make it easy for anyone to launch a scam.

- Money Laundering: Crypto’s global nature allows scammers to move stolen funds across borders quickly, making it hard for authorities to track or recover them.

4. Regulatory Gaps

- Lack of Oversight: Many countries still lack clear rules for crypto, making it easier for scammers to operate without fear of punishment.

- Cross-Border Operations: Scammers can target victims anywhere in the world, often using fake identities and offshore companies.

The Most Common—and Dangerous—Types in 2025

| Scam Type | Description | Example/Red Flag |

|---|---|---|

| AI Deepfake Scams | Fake videos or audio impersonate celebrities or CEOs to request crypto or sensitive info. | Elon Musk “live” giveaway |

| Pig Butchering | Long-term trust-building, often romantic, before convincing victims to invest in fake crypto. | Sudden investment pitch after weeks |

| Fake Giveaways | “Send crypto, get double back!”—often using fake celebrity accounts and slick graphics. | Unrealistic promises, urgent deadlines |

| Phishing & Fake Apps | Fake wallet apps or websites steal your login details or private keys. | Misspelled URLs, fake app stores |

| Pump and Dump | Coordinated hype inflates a token’s price; scammers sell off, crashing the value. | Sudden price spikes, no real news |

| Ponzi/Pyramid Schemes | Promise high returns, pay old investors with new investors’ money, often disguised as mining or MLM. | “Guaranteed 20% monthly returns!” |

| Address Poisoning | Scammers send tiny amounts from similar-looking addresses to trick you into copying the wrong one. | Unfamiliar small deposits |

| Fake Donations | Scammers pose as charities or disaster relief, asking for crypto donations. | Urgent requests for “emergency” funds |

| Job/Loan Scams | Fake jobs or loans requiring an upfront crypto payment. | “Pay a fee to unlock your new job” |

| Rug Pulls | Developers hype a new token, attract investors, then disappear with the funds. | No team info, sudden token crash |

| Recovery Scams | Fake “recovery” services promise to get your lost crypto back—for a fee. | Demanding upfront payment |

Detailed Breakdown of Each Type

AI Deepfake Scams

- How It Works: Scammers use AI to create fake videos or audio of famous people or trusted contacts. These deepfakes might appear in live streams, video calls, or social media posts.

- Real Example: In 2024, a deepfake video of Elon Musk was used to promote a fake crypto giveaway. Victims sent millions to the scammer’s wallet.

- How to Spot: Look for strange video glitches, odd speech patterns, or requests that seem out of character. Always verify requests through another channel.

Pig Butchering

- How It Works: Scammers build a relationship with you over time, often pretending to be a romantic interest or a new friend. Once trust is built, they introduce a “can’t-miss” crypto investment.

- Real Example: Victims have reported losing life savings after being convinced to invest in fake crypto platforms by someone they thought they knew.

- How to Spot: Be cautious if someone you meet online quickly moves the conversation to investments or asks for money.

Fake Giveaways

- How It Works: Scammers promise to double or triple your crypto if you send them some first. These scams often use fake celebrity accounts or hacked social media pages.

- Real Example: Fake Twitter accounts of celebrities like Vitalik Buterin and Elon Musk have been used for these scams.

- How to Spot: No legitimate giveaway will ever ask you to send money first.

Phishing & Fake Apps

- How It Works: Scammers create fake wallet apps or websites that look real but are designed to steal your login details or private keys.

- Real Example: Fake MetaMask apps have appeared on app stores, stealing users’ funds.

- How to Spot: Always download apps from official sources. Double-check URLs for misspellings or extra characters.

Pump and Dump

- How It Works: Scammers hype up a new token, causing its price to skyrocket. Once enough people buy in, the scammers sell their tokens, crashing the price.

- Real Example: Many meme coins and low-cap tokens have been used in pump-and-dump scams.

- How to Spot: Be wary of sudden price spikes, especially if there’s no real news or development behind the token.

Ponzi and Pyramid Schemes

- How It Works: These schemes promise high returns and pay old investors with new investors’ money. They often disguise themselves as mining operations or multi-level marketing (MLM) programs.

- Real Example: BitConnect was a famous Ponzi scheme that collapsed, costing investors billions.

- How to Spot: Guaranteed returns and recruitment-based rewards are big red flags.

Address Poisoning

- How It Works: Scammers send small amounts of crypto from addresses that look almost identical to yours. When you copy and paste addresses for future transactions, you might accidentally send funds to the scammer.

- Real Example: Address poisoning attacks have increased as more people use copy-paste for crypto transactions.

- How to Spot: Always double-check the full address before sending crypto, not just the first and last few characters.

Fake Donations

- How It Works: After disasters or crises, scammers create fake charity campaigns, often using stolen logos or deepfakes.

- Real Example: Fake donation pages appeared after major earthquakes and floods, tricking people into sending crypto to scammers.

- How to Spot: Verify charities through official websites and never donate through links sent by strangers.

Job and Loan Scams

- How It Works: Scammers post fake job ads or offer fake loans, but require an upfront payment in crypto for “processing” or “security.”

- Real Example: Victims have lost money to fake recruiters and lenders who disappear after receiving payment.

- How to Spot: Legitimate jobs and loans never require payment upfront.

Rug Pulls

- How It Works: Developers hype a new token, attract investors, then suddenly sell all their holdings and disappear, crashing the token’s value.

- Real Example: Many DeFi projects have ended in rug pulls, with millions lost.

- How to Spot: Avoid projects with anonymous teams, no audits, or sudden liquidity withdrawals.

Recovery Scams

- How It Works: After being scammed, victims are targeted again by fake “recovery” services that promise to get their money back for a fee.

- Real Example: Many victims of pig butchering or fake giveaways are contacted by “recovery experts” who only want more money.

- How to Spot: No real recovery service will guarantee to get your crypto back, especially for a fee.

Advanced Tactics in 2025

AI-Powered Impersonation

- Deepfake Calls: Scammers can now call you with AI-generated voices and video, making it almost impossible to tell real from fake.

- Fake Customer Support: Some scammers create fake support lines for popular wallets or exchanges. When you call, they ask for your private keys or passwords.

Social Engineering and Long Cons

- Multi-Platform Attacks: Scammers might contact you on several platforms at once—email, SMS, social media—to make their story more believable.

- Personalized Scams: Using data from social media, scammers craft messages that mention your job, hobbies, or friends.

Address Poisoning

- Automated Scripts: Bots can scan the blockchain for new wallet addresses and immediately send tiny transactions to start the poisoning process.

- Fake Transaction History: Poisoned addresses might even appear in your wallet’s transaction history, making them seem familiar.

Polycrime and Money Laundering

- Mixers and Tumblers: Scammers use crypto mixing services to hide the origin of stolen funds, making it harder for law enforcement to trace them.

- Cross-Chain Swaps: Moving stolen tokens between different blockchains to further confuse tracking efforts.

Real-World Stories and Case Studies

“I received a WhatsApp message from a friend asking for help with a crypto investment. The message used their photo and writing style, but it turned out their account was hacked. I lost $500 before realizing it was a scam.”

— Victim, Lagos, 2025

“After losing money in a fake token sale, I was contacted by a ‘recovery expert’ who promised to get my funds back for a fee. I paid, but never heard from them again.”

— Victim, South Africa, 2024

Key Warning Signs

- Requests for Private Keys or Seed Phrases: No real service will ever ask for these.

- Guaranteed or Unrealistic Returns: Crypto is risky—no one can promise profits.

- Aggressive Marketing or Urgency: Scammers push you to act fast or miss out.

- Anonymous or Fake Teams: No real information about the project leaders.

- Unsolicited Offers: Random messages about investments, jobs, or giveaways.

- Fake Documents or Whitepapers: Poorly written, vague, or copied project documents.

- Strange Payment Requests: Asking for crypto to unlock funds or pay taxes.

How to Spot and Avoid Them

Do Your Own Research (DYOR)

- Verify Team Members: Check LinkedIn and other platforms for real profiles.

- Read the Whitepaper: Look for clear, detailed plans and realistic goals.

- Check Community Feedback: Use forums, social media, and scam trackers.

- Look for Audits and Regulation: Only trust projects with third-party audits and clear compliance.

Protect Your Wallets

- Use Separate Wallets: One for daily use, one for long-term storage, one for testing.

- Enable Multi-Factor Authentication: Protect all accounts and wallets.

- Never Share Private Keys: Keep them offline and secure.

- Double-Check Addresses: Always verify the full address before sending crypto.

Stay Informed

- Join Crypto Communities: Follow reputable sources for scam alerts.

- Update Software: Use the latest versions and secure your devices.

- Double-Check URLs: Only download apps from official sources.

- Monitor Scam Trackers: Stay aware of new threats.

What To Do If You’re Scammed

- Document Everything: Save messages, emails, and transaction details.

- Report to Authorities: Contact local police, cybercrime units, or financial regulators.

- Warn Others: Share your experience to help others avoid scams.

- Do Not Pay Recovery Scammers: No real service can guarantee to get your funds back for a fee.

Quotes

- “Crypto scams are getting smarter, more creative, and harder to detect than ever before.”

- “Today’s crypto scams go far beyond the old tricks of phishing emails or fake websites.”

- “Scammers now use artificial intelligence, deepfake videos, social engineering, and even long-term psychological manipulation to target unsuspecting victims.”

- “Understanding how crypto scams operate, why they are getting smarter, and what new tactics you might face is essential for protecting your funds and your personal information.”

- “No legitimate giveaway will ever ask you to send money first.”

- “If something sounds too good to be true, it probably is.”

- “Knowledge is your best defense against the ever-evolving world of crypto scams.”

Highlighted Points

- Crypto scams are rapidly evolving, using advanced technologies like AI and deepfakes.

- Scammers target both beginners and experienced traders, often using social engineering and psychological tricks.

- Common scam types in 2025 include AI deepfake scams, pig butchering, fake giveaways, phishing, pump and dump, Ponzi schemes, address poisoning, fake donations, job/loan scams, rug pulls, and recovery scams.

- Red flags include requests for private keys, guaranteed profits, aggressive marketing, anonymous teams, unsolicited offers, and strange payment requests.

- Always verify project teams, read whitepapers, check for audits, and use official sources for apps and wallets.

- Use multi-factor authentication, hardware wallets for large amounts, and never share private keys or seed phrases.

- Stay informed by joining crypto communities and monitoring scam trackers.

- If scammed, document everything, report to authorities, and warn others—never pay for “recovery” services.

- The future of crypto scams will involve even more advanced technology and tactics, making ongoing vigilance essential.

Frequently Asked Questions

Q: Can I recover my money after a crypto scam?

A: Recovery is very difficult. Beware of “recovery” scams that ask for more money. Always report to authorities and your wallet provider.

Q: Are all new crypto projects risky?

A: Not all, but many new projects lack transparency. Always research before investing.

Q: How can I check if a project is a scam?

A: Use scam trackers, check for real team info, read independent reviews, and look for regulatory compliance.

How to Report and Get Help

If you suspect you’ve been targeted by a crypto scam, take these steps:

- Stop Communication: Do not reply to the scammer.

- Contact Your Wallet Provider: See if they can freeze or flag the transaction.

- File a Report: With your local cybercrime unit or financial regulator.

- Warn Others: Share your experience online and with friends.

Comprehensive Checklist to Stay Safe

- Do your own research (DYOR) before investing.

- Never share your private keys or seed phrases.

- Use hardware wallets for large amounts.

- Enable two-factor authentication.

- Be skeptical of unsolicited offers and urgent requests.

- Check team legitimacy and project transparency.

- Monitor scam trackers and crypto news.

- Report suspicious activity immediately.

Visual Guide to Red Flags

- Fake Social Media Accounts: Look for small changes in usernames, low follower counts, or recent account creation.

- Unrealistic Promises: “Double your money overnight!” is a classic scam line.

- Poor Grammar and Spelling: Many scam websites and messages have obvious errors.

- No Verifiable Contact Info: Legitimate projects have clear ways to reach their team.

- Pressure to Act Fast: Scammers want you to make decisions without thinking.

conclusion

Scammers are always adapting. With AI, blockchain, and new financial tools, crypto scams will keep getting smarter. Stay alert, keep learning, and always double-check before making any crypto transaction. Knowledge is your best defense against the ever-evolving world of crypto scams.