Is Buy Now, Pay Later a Financial Lifesaver or a Trap?

Introduction

Buy Now Pay Later (BNPL) services have surged in popularity in recent years, offering consumers the ability to purchase products immediately and pay for them in installments over time. As 2025 unfolds, this payment method is becoming a common option at checkout, both online and in physical stores. But is BNPL a financial lifesaver that provides flexibility and convenience, or is it a trap that leads to debt and financial stress? This comprehensive guide explores the benefits, risks, and real-world examples to help you decide.

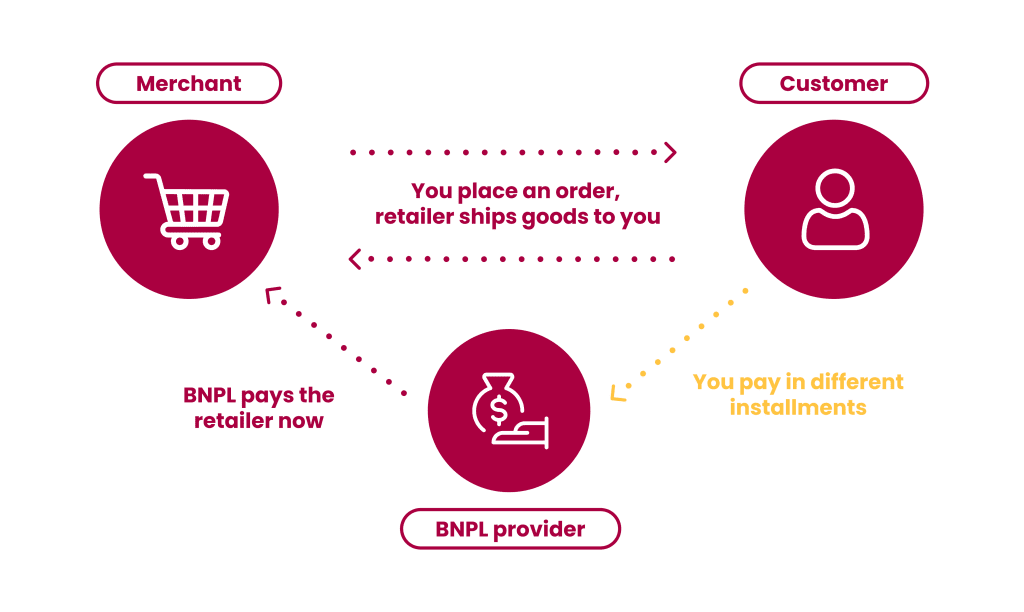

What Is Buy Now Pay Later and How Does It Work?

Buy Now Pay Later is a short-term financing option allowing consumers to split purchases into smaller payments, often interest-free if paid on time. Popular providers include Klarna, Affirm, Afterpay, and PayPal.

How BNPL Works:

- You select BNPL at checkout.

- You make a down payment (typically 0-25%).

- The remaining balance is paid in equal installments over weeks or months.

- If payments are made on time, usually no interest is charged.

- Missing payments can result in fees and credit score impacts.

| Step | Description |

|---|---|

| Purchase | Buy item using BNPL option. |

| Initial Payment | Pay a portion upfront (sometimes zero). |

| Installments | Pay remaining balance in scheduled payments. |

| Completion or Fees | Pay on time to avoid fees; late payments incur penalties. |

The Benefits of Buy Now Pay Later: A Financial Lifesaver?

1. Increased Purchasing Power

BNPL allows consumers to afford larger purchases by spreading payments, making items more accessible without needing credit cards or large upfront cash.

2. Interest-Free Payment Plans

Many BNPL plans offer zero interest if paid on time, saving consumers from high credit card interest rates.

3. Simple and Fast Approval

BNPL providers typically require minimal credit checks, making it easier for people with limited credit history to access financing.

4. Flexible Payment Options

Consumers can often choose payment schedules that fit their budgets, such as biweekly or monthly installments.

5. Convenience and Instant Gratification

You get the product immediately without waiting to save the full amount, which can be helpful in emergencies or for essential purchases.

The Risks of Buy Now Pay Later: A Potential Financial Trap

1. Encourages Overspending and Impulse Buying

The ease of BNPL can lead consumers to purchase more than they can afford, increasing debt risk.

2. Late Fees and Penalties

Missed payments often trigger late fees, which can accumulate quickly and offset the interest-free benefit.

3. Negative Impact on Credit Scores

Some BNPL providers perform hard credit checks or report delinquencies, which can lower credit scores and affect future borrowing.

4. Multiple Concurrent Loans

Using BNPL across different retailers can lead to several overlapping payment plans, making it difficult to track and manage finances.

5. Limited Consumer Protections

Unlike credit cards, BNPL purchases may not offer strong dispute resolution or fraud protection, complicating returns or refunds.

Case Studies: Real-Life Experiences with Buy Now Pay Later

Case Study 1: Emily’s Positive Experience

Emily used BNPL to buy a new laptop costing $1,200. She made a 25% down payment and paid the rest over four months without interest. The flexible payments helped her manage cash flow without credit card debt. She paid on time and avoided fees, calling BNPL a “financial lifesaver” during a tight budget period.

Case Study 2: James’s Debt Trap

James frequently used BNPL for clothing and gadgets, accumulating four active plans totaling $2,500. He missed two payments, incurring late fees and damaging his credit score. The overlapping payments strained his monthly budget, forcing him to take a high-interest loan to cover debts. James describes BNPL as a “trap” that worsened his financial situation.

Comparing BNPL with Credit Cards and Traditional Loans

| Feature | BNPL | Credit Cards | Personal Loans |

|---|---|---|---|

| Approval Process | Simple, minimal credit check | Requires credit check | Requires credit check |

| Interest Rates | Often 0% if paid on time | Typically 15%-25% APR | Varies, often lower than cards |

| Payment Flexibility | Fixed installments | Minimum monthly payments | Fixed monthly payments |

| Credit Impact | Possible negative impact | Builds credit if managed well | Builds credit if paid timely |

| Consumer Protections | Limited | Strong protections | Moderate protections |

| Risk of Overspending | High | High | Moderate |

How to Use Buy Now Pay Later Responsibly

- Budget Carefully: Only use BNPL for purchases you can afford to repay on time.

- Track All Payments: Keep a calendar or use apps to monitor due dates.

- Avoid Multiple BNPL Plans: Limit the number of active BNPL agreements to reduce complexity.

- Read Terms and Conditions: Understand fees, penalties, and payment schedules before committing.

- Use BNPL for Essential or Planned Purchases: Avoid impulse buys with BNPL.

The Impact of BNPL on Businesses

Businesses benefit from BNPL through increased sales and higher average order values. However, merchants pay fees (1.5% to 7% per transaction), which can reduce profit margins. BNPL also attracts younger customers who may not have credit cards, expanding the customer base.

Regulatory and Consumer Protection Developments in 2025

As BNPL grows, regulators are increasing scrutiny to protect consumers from debt traps. New rules may require clearer disclosures, limits on late fees, and better credit reporting practices.

Psychological Effects of Buy Now Pay Later on Spending Behavior

Buy Now Pay Later (BNPL) services can influence how consumers perceive money and spending. Understanding these psychological effects can help you make better financial decisions.

The Illusion of “Free Money”

BNPL breaks down payments into smaller chunks, which can make purchases feel more affordable than they actually are. This “free money” illusion may lead to overspending or buying items that aren’t truly needed.

Reduced Pain of Paying

Paying over time reduces the immediate “pain” of spending a large sum, which can encourage impulse purchases. This can increase the risk of accumulating multiple payment plans without fully considering the total cost.

Overconfidence in Future Income

Consumers may overestimate their ability to pay future installments, especially if their income fluctuates. This optimism bias can result in missed payments and fees.

Alternatives to Buy Now Pay Later: Exploring Other Payment Options

If BNPL doesn’t feel right for you, consider these alternatives that might better suit your financial situation:

| Payment Option | Description | Pros | Cons |

|---|---|---|---|

| Traditional Credit Card | Revolving credit with minimum payments | Builds credit history, rewards | High interest if balance not paid |

| Personal Loan | Fixed loan with set repayment schedule | Lower interest than credit cards | Requires credit approval |

| Layaway Plans | Pay in installments before receiving item | No interest, pay upfront | Must wait for product delivery |

| Savings First | Save money before purchasing | No debt or interest | Delays gratification |

Industry Trends and the Future of Buy Now Pay Later in 2025

The BNPL market is evolving rapidly, influenced by technology, regulation, and consumer behavior.

Increased Regulation

Governments worldwide are introducing regulations to protect consumers, such as caps on late fees and mandatory credit checks.

Integration with Digital Wallets and Apps

BNPL is becoming integrated with popular digital wallets, making checkout faster and more seamless.

Expansion Beyond Retail

BNPL is expanding into services like healthcare, travel, and education, offering financing for larger expenses.

Growing Competition

More fintech companies are entering the BNPL space, leading to better terms and more consumer choices.

Tips for Managing Buy Now Pay Later Payments Effectively

To avoid falling into debt traps, consider these practical tips:

- Consolidate Payments: If you have multiple BNPL plans, try to consolidate payments to simplify management.

- Set Reminders: Use calendar alerts or budgeting apps to track due dates and avoid late fees.

- Review Your Budget Monthly: Adjust your spending to accommodate upcoming BNPL payments.

- Keep Emergency Savings Separate: Avoid using your emergency fund to cover BNPL payments.

- Communicate with Providers: If you face financial hardship, contact BNPL providers to discuss payment plans or deferments.

How BNPL Affects Credit Scores: What You Need to Know

Not all BNPL providers report to credit bureaus, but some do. Here’s what you should know:

- On-Time Payments: Can help build your credit if reported.

- Late Payments: Can damage your credit score and make future borrowing harder.

- Hard Credit Checks: Some providers perform hard inquiries, which may temporarily lower your score.

- Credit Reporting Variability: Policies differ by provider; always check before signing up.

Consumer Protection: What Rights Do You Have When Using BNPL?

Understanding your rights can help you navigate BNPL safely and avoid pitfalls.

Key Consumer Protections to Look For

- Clear Disclosure of Terms: Providers should clearly outline payment schedules, fees, and penalties before you commit.

- Right to Cancel: Some BNPL agreements allow cancellation within a cooling-off period without penalty.

- Dispute Resolution: In case of faulty goods or services, know how to dispute charges effectively.

- Privacy and Data Security: Ensure your personal and financial information is protected by the provider.

What to Do If You Encounter Issues

- Contact the BNPL provider immediately to resolve payment or service disputes.

- Report unfair practices to consumer protection agencies or financial regulators.

- Keep records of all communications and transactions for evidence.

Budgeting Tips to Manage BNPL Payments Without Stress

Effective budgeting is essential to avoid BNPL becoming a financial burden.

Create a BNPL Payment Calendar

List all upcoming BNPL payments with due dates and amounts. Use digital calendars or budgeting apps with reminder functions.

Prioritize BNPL Payments in Your Budget

Treat BNPL installments like fixed bills that must be paid monthly to avoid fees.

Adjust Spending Habits

Cut back on non-essential spending to free up cash for BNPL payments.

Build a Buffer Fund

Maintain a small emergency fund to cover unexpected BNPL payments or late fees.

The Global Perspective: How BNPL Is Used Around the World

BNPL adoption varies by region, influenced by cultural, economic, and regulatory factors.

| Region | Popularity Level | Regulatory Environment | Consumer Behavior Trends |

|---|---|---|---|

| North America | High | Increasing regulation and oversight | High usage among Millennials and Gen Z |

| Europe | Growing | Strong consumer protection laws | Preference for transparency and affordability |

| Asia-Pacific | Rapid Growth | Emerging regulations, varied by country | High mobile payment integration |

| Latin America | Moderate | Developing regulatory frameworks | Increasing e-commerce adoption |

Understanding these trends helps consumers and businesses adapt to local BNPL landscapes.

How to Choose the Right Buy Now Pay Later Provider

Not all BNPL services are created equal. Here’s what to consider:

- Fees and Interest: Look for providers with transparent, low or no fees.

- Repayment Terms: Choose plans that fit your budget and income cycle.

- Credit Reporting: Understand how the provider reports to credit bureaus.

- Customer Service: Access to responsive support is critical if issues arise.

- Merchant Acceptance: Check if your favorite stores accept the BNPL provider.

The Environmental Impact of BNPL and Consumer Spending

While BNPL encourages spending, it also raises questions about sustainability.

- Increased consumption can lead to more waste and environmental strain.

- Some BNPL providers are partnering with eco-friendly brands or offering carbon offset options.

- Consumers can use BNPL responsibly by prioritizing sustainable purchases.

The Role of Financial Literacy in Navigating Buy Now Pay Later

Financial literacy plays a crucial role in helping consumers make informed decisions about BNPL services.

Why Financial Literacy Matters

- Understanding interest rates, fees, and repayment schedules helps avoid unexpected costs.

- Awareness of budgeting techniques ensures BNPL payments fit within your financial means.

- Knowledge of credit scores and credit reporting can prevent long-term damage from missed payments.

How to Improve Financial Literacy

- Take free online courses or workshops on personal finance.

- Use budgeting apps that educate while tracking expenses.

- Read consumer guides and articles about credit and debt management.

Impact on BNPL Usage

Consumers with higher financial literacy are more likely to use BNPL responsibly, treating it as a tool rather than a crutch.

The Influence of Technology on Buy Now Pay Later Services

Technology is reshaping how BNPL operates and integrates with everyday shopping.

Mobile Integration and Seamless Checkout

- BNPL options are increasingly embedded in mobile wallets and apps, offering faster checkout experiences.

- AI-powered credit assessments allow instant approval decisions, sometimes without traditional credit checks.

Data Privacy and Security Concerns

- BNPL providers collect extensive personal and financial data, raising privacy issues.

- Consumers should review privacy policies and opt for providers with strong security measures.

Future Innovations

- Blockchain and decentralized finance (DeFi) might introduce new BNPL models with greater transparency.

- Enhanced AI could personalize payment plans based on spending habits and income fluctuations.

Ethical Considerations Surrounding Buy Now Pay Later

The rapid growth of BNPL raises ethical questions for providers, regulators, and consumers.

Responsibility of Providers

- Ensuring clear, honest communication about risks and fees.

- Avoiding targeting vulnerable populations with aggressive marketing.

- Implementing fair credit assessments to prevent over-indebtedness.

Role of Regulators

- Balancing consumer protection with innovation.

- Enforcing transparency and fair lending practices.

Consumer Responsibility

- Using BNPL consciously, avoiding impulse purchases.

- Seeking help if struggling with debt.

How BNPL Affects Different Demographics

BNPL usage varies widely among age groups, income levels, and regions.

| Demographic Group | Typical Usage Pattern | Financial Impact |

|---|---|---|

| Millennials | High usage for tech and fashion items | Risk of debt but also financial flexibility |

| Gen Z | Early adopters, frequent small purchases | Vulnerable to overspending |

| Low-Income Consumers | Use for essential items, risk of debt | Can face financial strain |

| Older Adults | Lower usage, cautious approach | Less exposure to BNPL risks |

Understanding these patterns helps tailor education and support programs.

Strategies for Businesses Offering Buy Now Pay Later

Businesses benefit from BNPL but must manage risks carefully.

Benefits for Merchants

- Increased sales and average order values.

- Attracting younger, credit-constrained customers.

Risks and Challenges

- Fees paid to BNPL providers reduce margins.

- Potential for increased returns or fraud.

Best Practices

- Educate customers on responsible use.

- Monitor customer repayment behavior.

- Choose reputable BNPL partners with good consumer protections.

Conclusion

Buy Now Pay Later can be a financial lifesaver when used responsibly, offering flexibility and interest-free payments. However, it can quickly become a trap if it encourages overspending, missed payments, and debt accumulation. Understanding the benefits and risks, budgeting carefully, and using BNPL wisely are essential to avoid pitfalls in 2025.