How to Build an Emergency Fund from Scratch in 2025

Introduction

Building an emergency fund is one of the most powerful financial steps you can take to protect yourself from unexpected expenses and economic uncertainty in 2025. This guide will show you how to build an emergency fund from scratch, with clear, simple steps, practical advice, and real-life examples to help you succeed.

What Is an Emergency Fund and Why You Need One in 2025

An emergency-fund is money set aside specifically for unexpected expenses such as job loss, medical emergencies, car repairs, or urgent home fixes. In 2025, with rising costs and economic uncertainties, having a robust emergency fund is more important than ever.

Financial experts recommend saving enough to cover three to six months of essential living expenses. The average household should aim for about $35,000 in emergency savings to cover six months of expenses, reflecting increases in healthcare and living costs.

Step 1: Assess Your Monthly Expenses to Build Emergency Fund

Before you start saving, you need to know how much money you spend monthly on essentials like:

- Rent or mortgage

- Utilities (electricity, water, internet)

- Food and groceries

- Transportation (car payments, fuel, public transit)

- Healthcare and insurance

- Other necessary bills

Create a detailed budget listing these expenses to understand your financial baseline. This will help you set a realistic savings goal for your emergency fund.

Step 2: Set a Realistic and Positive Savings Goal

Start with a manageable goal. Instead of aiming for six months’ expenses immediately, begin with:

- $500 or

- One month of essential expenses

Gradually increase your target as you build confidence and financial discipline. This positive, step-by-step approach prevents overwhelm and keeps you motivated.

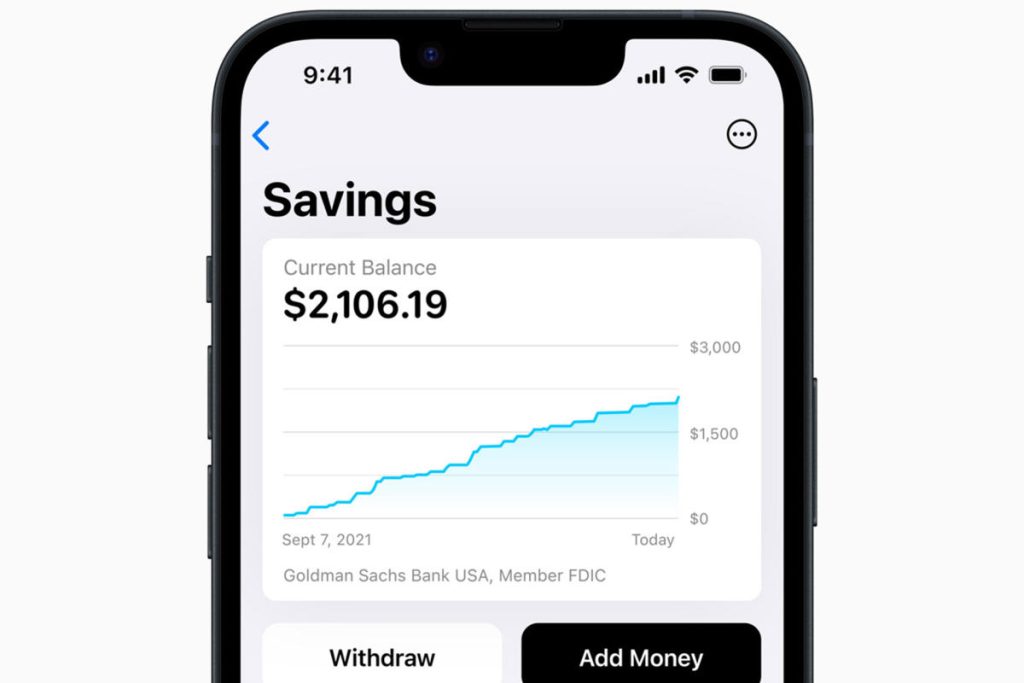

Step 3: Open a Dedicated High-Yield Savings Account

Keep your emergency fund separate from your everyday spending money. Use a high-yield savings account or a money market account to earn interest while keeping funds accessible.

Options include:

| Account Type | Interest Rate Range | Accessibility | Notes |

|---|---|---|---|

| High-Yield Savings Account | 5% – 16% P.A. | Easy access | Interest grows your savings |

| Money Market Account | 3% – 10% P.A. | Moderate access | Good balance of interest and liquidity |

| Fixed or Locked Savings | 9% – 16% P.A. | Limited access until maturity | Higher interest but penalties for early withdrawal |

For example, some financial institutions offer flexible savings plans with interest rates up to 16% per annum, allowing you to automate savings and track progress.

Step 4: Create a Budget and Cut Unnecessary Expenses

To free up money for your emergency-fund:

- Track your income and spending carefully.

- Identify non-essential expenses to reduce or eliminate.

- Look for cheaper alternatives for regular purchases.

- Use the “cut back, cut costs, cut out” method to optimize spending.

Even small savings from daily expenses can add up significantly over time.

Step 5: Automate Your Savings and Use Windfalls

Make saving effortless by:

- Setting up automatic transfers from your checking to your emergency fund account every payday.

- Depositing bonuses, tax refunds, or cash gifts directly into your emergency fund.

Automation helps maintain consistency and prevents the temptation to spend.

Case Study 1: Sarah’s Journey to Build Emergency Fund from Scratch

Sarah, a 28-year-old teacher, started with a goal of saving $500. She tracked her monthly expenses and realized she could save $100 per month by cutting back on dining out and subscription services. She opened a high-yield savings account with 9% interest and automated monthly transfers.

Within six months, Sarah had saved $600 plus earned interest, giving her confidence to increase her goal to cover three months of expenses. Her emergency fund now protects her against unexpected costs like car repairs and medical bills.

Case Study 2: Mark’s Emergency Fund Success with Locked Savings

Mark, a freelance graphic designer, used a locked savings plan with a 12% interest rate. He saved a fixed amount monthly for one year without withdrawals. The locked plan forced discipline and earned him more interest than a regular savings account.

When his laptop broke down, Mark used his emergency fund to replace it without financial stress. After replenishing the fund, he plans to continue saving for six months of expenses.

How Much Should You Save?

| Savings Goal | Purpose | Monthly Savings Example (Based on $3,000 Expenses) |

|---|---|---|

| $500 | Starter emergency fund | $50 per month for 10 months |

| 1 Month Expenses | Basic safety net | $250 per month for 4 months |

| 3 Months Expenses | Moderate protection | $250 per month for 12 months |

| 6 Months Expenses | Strong financial security | $500 per month for 12 months |

Tips to Stay Motivated

- Celebrate milestones, like reaching $500 or one month’s expenses saved.

- Visualize the peace of mind your fund provides.

- Review and adjust your budget regularly.

- Share your goals with a trusted friend or financial coach for accountability.

Common Mistakes to Avoid

- Using the emergency fund for non-emergencies.

- Setting unrealistic savings goals that cause discouragement.

- Keeping the fund in accounts with no or very low interest.

- Ignoring inflation and rising costs in your savings target.

Understanding the Psychology Behind Building an Emergency Fund

Building an emergency fund is not just about numbers, it’s also about mindset. Many people struggle with saving due to emotional spending, lack of motivation, or financial anxiety.

Tips to Develop a Saving Mindset:

- Visualize Your Financial Freedom: Imagine the peace of mind you will have when your emergency fund is fully funded.

- Set Small, Achievable Milestones: Celebrate every $100 or $500 saved to build momentum.

- Practice Delayed Gratification: Before making non-essential purchases, wait 24 hours to decide if it’s necessary.

- Use Positive Affirmations: Remind yourself daily that saving money is a step toward security and independence.

Alternative Ways to Build Emergency Fund Faster

If traditional saving feels slow, consider these creative approaches to boost your emergency fund quickly:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Side Hustles | Freelance work, gig economy jobs, or online sales | Extra income stream | Requires time and effort |

| Selling Unused Items | Sell clothes, gadgets, or furniture | Quick cash influx | May not be sustainable |

| Cash-Back and Rewards Apps | Use apps that give cashback on purchases | Earn while spending | Requires disciplined spending |

| Temporary Budget Cuts | Pause subscriptions, reduce dining out temporarily | Rapid savings increase | May feel restrictive |

How to Protect Your Fund from Inflation in 2025

Inflation reduces the purchasing power of your savings over time. :

- Choose Accounts with Competitive Interest Rates: High-yield savings or money market accounts that beat inflation.

- Consider Inflation-Protected Securities: Such as Treasury Inflation-Protected Securities (TIPS) for part of your fund.

- Regularly Review and Adjust Your Savings Goal: Increase your target amount annually to keep pace with inflation.

Emergency Fund vs. Other Financial Priorities: What Comes First?

While building an emergency fund is critical, you may wonder how it fits with other financial goals:

| Priority | When to Focus On It | Why It Matters |

|---|---|---|

| Emergency Fund | Immediately, start small and build gradually | Provides financial safety net |

| High-Interest Debt Payoff | After $500 – $1,000 emergency fund is built | Reduces costly interest payments |

| Retirement Savings | Once emergency fund and debts are managed | Secures long-term financial future |

| Investment & Wealth Growth | After emergency fund and debts are settled | Builds wealth and financial freedom |

How to Rebuild Your Fund After Using It

Using your emergency fund is sometimes unavoidable. Here’s how to get back on track:

- Assess Your Current Financial Situation: Understand how much you used and how much you need to rebuild.

- Adjust Your Budget Temporarily: Allocate more funds toward rebuilding your emergency savings.

- Resume Automatic Transfers: If you paused savings, restart automatic contributions immediately.

- Avoid Using the Fund for Non-Emergencies: Stay disciplined to prevent repeated depletion.

Emergency Fund for Families: Special Considerations

Families often face unique financial challenges. Here’s how to tailor your emergency fund strategy:

- Include Childcare and Education Costs: Factor in expenses like daycare, school fees, and supplies.

- Plan for Medical and Dental Emergencies: Children may have unexpected health needs.

- Account for Larger Household Expenses: Utilities, groceries, and transportation costs increase with family size.

- Consider Dual Income Stability: If both parents work, evaluate job security and income variability.

Smart Withdrawal Strategies When You Need to Use Your Emergency Fund

Building an emergency fund is essential, but knowing when and how to use it wisely is just as important. Misusing your emergency fund can leave you vulnerable when real emergencies strike.

When to Use Your Emergency Fund

Only tap into for true emergencies, such as:

- Unexpected job loss or income reduction

- Medical emergencies or urgent healthcare expenses

- Major home repairs (e.g., plumbing, electrical issues)

- Car repairs that affect your ability to work or commute

- Other unforeseen, unavoidable expenses

Avoid using your emergency fund for planned expenses, vacations, or discretionary purchases.

How to Withdraw Funds Responsibly

- Withdraw only the necessary amount: Don’t empty your fund unless absolutely required.

- Keep records: Track withdrawals and reasons to maintain financial awareness.

- Avoid borrowing against your emergency fund: Resist the temptation to use it as collateral or for loans.

Replenishing Your Fund After Use

After using your emergency fund, it’s critical to rebuild it quickly to maintain your financial safety net. Here’s how:

| Step | Action | Tips |

|---|---|---|

| 1. Assess the Damage | Calculate how much you withdrew and why | Understand your new savings target |

| 2. Adjust Your Budget | Temporarily increase savings contributions | Cut back on non-essential spending |

| 3. Automate Savings | Restart or increase automatic transfers | Use apps or bank features for discipline |

| 4. Avoid New Debt | Don’t replace emergency fund with credit | Focus on cash savings to avoid interest |

| 5. Monitor Progress | Track your rebuilding monthly | Celebrate milestones to stay motivated |

Case: Rebuilding After Unexpected Car Repairs

Jessica had an emergency fund covering 4 months of expenses. When her car needed urgent repairs costing $1,200, she used part of her fund. After the repair, she increased her monthly savings from $200 to $300 and automated transfers to rebuild the fund within 6 months, ensuring she was protected for future surprises.

Understanding Different Types of Emergencies and Their Financial Impact

Emergencies come in many forms, and each can have a different financial impact. Knowing the types of emergencies you might face helps you prepare better.

- Health Emergencies: Unexpected medical bills, surgeries, or emergency room visits. These can be costly and sometimes not fully covered by insurance.

- Job Loss or Income Reduction: Losing a job or having reduced work hours affects your monthly income and ability to pay bills.

- Home Repairs: Issues like a broken furnace, leaking roof, or plumbing problems often require immediate attention and can be expensive.

- Vehicle Repairs: Car troubles can disrupt your daily routine and require urgent repair costs.

- Natural Disasters: Floods, storms, or fires can cause property damage and displacement, leading to significant expenses.

How to Involve Your Family in Financial Preparedness

Financial security is a family effort. Getting everyone on board can make saving easier and more effective.

- Discuss Financial Goals: Have open conversations about why saving money is important for the family’s security.

- Create a Family Budget: Involve family members in tracking expenses and identifying areas to save.

- Encourage Saving Habits: Teach children about saving money and the importance of emergency funds.

- Set a Family Savings Challenge: Make saving fun by setting goals and rewarding progress together.

This collaborative approach builds financial awareness and shared responsibility.

Using Employer Benefits to Support Your Savings

Many employers offer benefits that can indirectly help you save money or build a financial cushion.

- Health Savings Accounts (HSAs): If available, these accounts let you save pre-tax money for medical expenses.

- Flexible Spending Accounts (FSAs): Similar to HSAs, FSAs help cover healthcare costs with tax advantages.

- Employee Assistance Programs (EAPs): Some companies provide financial counseling or emergency loans.

- Retirement Plans with Matching: While not an emergency fund, contributing to retirement plans with employer matching boosts your overall financial security.

Make sure to explore and maximize these benefits to ease financial pressures.

How to Stay Financially Prepared During Economic Uncertainty

Economic changes can affect job security and living costs. Here are ways to stay prepared:

- Keep Expenses Low: Maintain a lean budget and avoid unnecessary spending.

- Diversify Income Sources: Consider part-time work, freelancing, or passive income streams.

- Maintain Good Credit: A strong credit score can help access loans if needed during tough times.

- Stay Informed: Follow financial news and adjust your plans accordingly.

Being proactive helps you weather economic shifts without panic.

Importance of Regular Financial Checkups

Just like health checkups, regular reviews of your finances keep you on track.

- Review Your Budget Monthly: Adjust for changes in income or expenses.

- Check Your Savings Progress: Ensure your emergency savings grow steadily.

- Update Your Financial Goals: Life changes such as marriage, children, or new jobs require plan adjustments.

- Evaluate Insurance Coverage: Make sure your health, home, and auto insurance meet your current needs.

Consistent financial checkups prevent surprises and keep you prepared.

Understanding Different Types of Emergencies and Their Financial Impact

Emergencies come in many forms, and each can have a different financial impact. Knowing the types of emergencies you might face helps you prepare better.

- Health Emergencies: Unexpected medical bills, surgeries, or emergency room visits. These can be costly and sometimes not fully covered by insurance.

- Job Loss or Income Reduction: Losing a job or having reduced work hours affects your monthly income and ability to pay bills.

- Home Repairs: Issues like a broken furnace, leaking roof, or plumbing problems often require immediate attention and can be expensive.

- Vehicle Repairs: Car troubles can disrupt your daily routine and require urgent repair costs.

- Natural Disasters: Floods, storms, or fires can cause property damage and displacement, leading to significant expenses.

By understanding these scenarios, you can better estimate how much money to set aside and prioritize your savings.

How to Involve Your Family in Financial Preparedness

Financial security is a family effort. Getting everyone on board can make saving easier and more effective.

- Discuss Financial Goals: Have open conversations about why saving money is important for the family’s security.

- Create a Family Budget: Involve family members in tracking expenses and identifying areas to save.

- Encourage Saving Habits: Teach children about saving money and the importance of emergency funds.

- Set a Family Savings Challenge: Make saving fun by setting goals and rewarding progress together.

This collaborative approach builds financial awareness and shared responsibility.

Using Employer Benefits to Support Your Savings

Many employers offer benefits that can indirectly help you save money or build a financial cushion.

- Health Savings Accounts (HSAs): If available, these accounts let you save pre-tax money for medical expenses.

- Flexible Spending Accounts (FSAs): Similar to HSAs, FSAs help cover healthcare costs with tax advantages.

- Employee Assistance Programs (EAPs): Some companies provide financial counseling or emergency loans.

- Retirement Plans with Matching: While not an emergency fund, contributing to retirement plans with employer matching boosts your overall financial security.

Make sure to explore and maximize these benefits to ease financial pressures.

How to Stay Financially Prepared During Economic Uncertainty

Economic changes can affect job security and living costs. Here are ways to stay prepared:

- Keep Expenses Low: Maintain a lean budget and avoid unnecessary spending.

- Diversify Income Sources: Consider part-time work, freelancing, or passive income streams.

- Maintain Good Credit: A strong credit score can help access loans if needed during tough times.

- Stay Informed: Follow financial news and adjust your plans accordingly.

Being proactive helps you weather economic shifts without panic.

Importance of Regular Financial Checkups

Just like health checkups, regular reviews of your finances keep you on track.

- Review Your Budget Monthly: Adjust for changes in income or expenses.

- Check Your Savings Progress: Ensure your emergency savings grow steadily.

- Update Your Financial Goals: Life changes such as marriage, children, or new jobs require plan adjustments.

- Evaluate Insurance Coverage: Make sure your health, home, and auto insurance meet your current needs.

FAQs About Building an Emergency Fund in 2025

How fast should I build?

Aim to save at least $500 quickly, then build to cover 3 to 6 months of expenses over 6 to 12 months.

Can I invest my emergency fund to get better returns?

Generally, emergency funds should be kept in low-risk, liquid accounts. Investing in stocks or volatile assets is risky for emergency savings.

What if I have irregular income?

Calculate your average monthly expenses over 6-12 months and save accordingly. Prioritize saving during high-income months.

Conclusion

Starting to build an emergency fund from scratch in 2025 is a positive and empowering financial decision. By assessing your expenses, setting realistic goals, choosing the right savings account, budgeting wisely, and automating your savings, you can create a financial safety net that protects you from life’s surprises.