How Safe Is Your Crypto Wallet? Experts Break It Down

In 2025, crypto wallet safety is more critical than ever. As digital assets grow in value and popularity, hackers and scammers become increasingly sophisticated. Understanding how safe your crypto wallet is requires knowing the types of wallets, common threats, and best security practices. This comprehensive guide breaks down everything you need to know to protect your cryptocurrency holdings effectively.

What Is Crypto Wallet Safety? Understanding the Basics

Crypto wallet safety refers to how well your cryptocurrency wallet protects your private keys and funds from unauthorized access, theft, or loss. Your wallet stores the cryptographic keys that grant access to your digital assets on the blockchain. If these keys are compromised, your funds can be stolen irreversibly.

Types of Crypto Wallets and Their Safety Profiles

| Wallet Type | Description | Safety Level | Use Case |

|---|---|---|---|

| Hot Wallets | Connected to the internet (e.g., MetaMask, Trust Wallet) | Moderate (vulnerable to hacks) | Daily trading, small holdings |

| Cold Wallets | Offline storage (e.g., Ledger, Trezor hardware wallets) | High (offline, less hackable) | Long-term storage, large holdings |

| Custodial Wallets | Managed by third parties (exchanges like Coinbase) | Varies (depends on provider) | Convenience, trading |

| Non-Custodial Wallets | User controls private keys (hardware or software) | High (user responsibility) | Full control, security-focused |

Cold wallets are the safest but less convenient, while hot wallets offer ease of use with higher risk.

Common Threats to Crypto Wallet Safety

1. Phishing Attacks

Fraudsters impersonate legitimate services to trick users into revealing private keys or seed phrases. Phishing can occur via fake websites, emails, or social media.

2. Malware and Keyloggers

Malicious software installed on your device can record keystrokes or capture screen data, stealing wallet credentials.

3. SIM Swap Attacks

Hackers hijack your phone number to intercept two-factor authentication (2FA) codes sent via SMS, gaining access to wallets.

4. Physical Theft or Loss

Losing hardware wallets or seed phrase backups can result in permanent loss of access.

5. Exchange Hacks and Custodial Risks

If you store funds on exchanges, breaches can lead to loss of assets, as you don’t control the private keys.

Best Practices to Enhance Crypto Wallet Safety

Use Hardware Wallets for Cold Storage

Hardware wallets like Ledger Nano X or Trezor Model T store private keys offline, making them immune to online hacks.

Enable Two-Factor Authentication (2FA)

Use authenticator apps (Google Authenticator, Authy) or hardware security keys (YubiKey) instead of SMS-based 2FA for stronger protection.

Create Strong, Unique Passwords

Avoid reusing passwords and use password managers to generate and store complex passwords.

Secure Your Seed Phrase Offline

Write your seed phrase on paper or metal plates and store it in a secure, fireproof location. Never share it digitally or with anyone.

Regularly Update Wallet Software

Keep wallet apps and firmware updated to patch security vulnerabilities.

Beware of Fake Wallets and Scams

Only download wallets from official sources. Verify URLs and avoid clicking suspicious links.

Advanced Security Measures for Institutional Crypto Wallet Safety

Institutions require enterprise-grade security beyond individual best practices.

- Multi-Party Computation (MPC) Wallets: Distribute key control among multiple parties to prevent single points of failure.

- Multi-Signature Wallets: Require multiple approvals for transactions, reducing insider threats.

- Governance Policies: Role-based access controls and approval hierarchies.

- Regular Audits: Continuous monitoring of wallet activity and permissions.

- Insurance Coverage: Partnering with insured custodians to mitigate financial risks.

Case Studies: Real-World Crypto Wallet Security Breaches and Lessons

Case Study 1: The 2021 Poly Network Hack

- Incident: Hackers exploited a vulnerability in Poly Network’s smart contract, stealing over $600 million.

- Lesson: Even decentralized platforms require rigorous security audits and quick patching.

Case Study 2: Ledger Data Breach 2020

- Incident: Personal data of over 1 million Ledger customers was leaked, leading to phishing attacks.

- Lesson: Protect personal information and beware of phishing attempts following data breaches.

Case Study 3: SIM Swap Attack on Twitter CEO

- Incident: Twitter CEO Jack Dorsey’s phone number was hijacked, highlighting SIM swap risks.

- Lesson: Use hardware 2FA keys and avoid SMS-based authentication.

How to Verify Your Crypto Wallet’s Legitimacy and Security

- Choose wallets that are open-source with active development on platforms like GitHub.

- Look for wallets with third-party security audits and certifications.

- Check for community reviews and reputation in crypto forums.

- Use wallets with built-in security features like transaction risk scanners and phishing alerts.

Emerging Trends in Crypto Wallet Safety

Biometric Authentication

Fingerprint and facial recognition add user-friendly yet secure access layers.

Decentralized Identity (DID)

User-owned digital identities secured on blockchain reduce reliance on passwords and centralized databases.

Multi-Chain Wallets

Support for multiple blockchains in one wallet enhances convenience without compromising security.

Hardware Wallet Innovations

New devices with touchscreen interfaces and Bluetooth connectivity improve usability while maintaining cold storage security.

Crypto Wallet Safety Checklist: A Practical Guide

| Step | Action | Why It Matters |

|---|---|---|

| 1. Choose Cold Wallet | Use hardware wallets for large holdings | Minimizes online attack risk |

| 2. Enable 2FA | Use authenticator apps or hardware keys | Adds extra authentication layer |

| 3. Secure Seed Phrase | Store offline in safe locations | Prevents unauthorized recovery |

| 4. Update Software Regularly | Keep wallet and device software current | Fixes security vulnerabilities |

| 5. Verify Wallet Sources | Download from official websites only | Avoids fake wallets and malware |

| 6. Use Multi-Sig for Large Funds | Require multiple approvals for transactions | Protects against internal fraud |

| 7. Monitor Account Activity | Regularly check transactions and logs | Detects suspicious activity early |

FAQs About Crypto Wallet Safety

Q: Can my crypto wallet be hacked?

A: Yes, especially hot wallets connected to the internet. Using hardware wallets and 2FA greatly reduces risk.

Q: What happens if I lose my seed phrase?

A: You lose access to your funds permanently. Seed phrase backups are critical.

Q: Are custodial wallets safe?

A: They depend on the provider’s security. You don’t control private keys, so risk is higher than non-custodial wallets.

Q: How can I avoid phishing scams?

A: Always verify URLs, avoid unsolicited links, and use security scanners in wallets.

Deep Dive into Crypto Wallet Types and Their Safety Features

Understanding the various crypto wallet types is fundamental to assessing crypto wallet safety. Each wallet type offers different trade-offs between security, convenience, and accessibility.

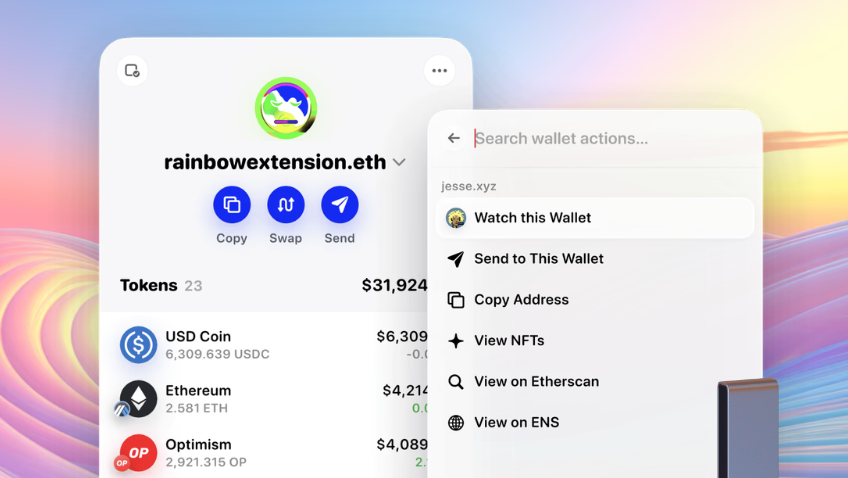

Hot Wallets: Convenience with Increased Risk

Hot wallets are software wallets connected to the internet, including mobile apps, desktop applications, and browser extensions.

- Examples: MetaMask, Trust Wallet, Coinbase Wallet.

- Security Features: Password protection, seed phrase backup, optional biometric authentication, and 2FA integration.

- Risks: Vulnerable to phishing attacks, malware, and hacking due to constant internet connection.

Hot wallets are ideal for active traders or users needing quick access but should only hold small amounts of crypto.

Cold Wallets: Offline Security for Long-Term Holding

Cold wallets store private keys offline, significantly reducing exposure to online threats.

- Hardware Wallets: Devices like Ledger Nano S/X, Trezor Model T physically isolate keys.

- Paper Wallets: Physical printouts of private keys and seed phrases, though less user-friendly and prone to physical damage.

- Security Advantages: Immune to online hacking, phishing, and malware.

- Risks: Physical theft, loss, or damage; improper seed phrase storage can lead to permanent loss.

Cold wallets are recommended for storing large amounts of cryptocurrency securely.

Custodial Wallets: Convenience at the Cost of Control

Custodial wallets are managed by third-party services such as exchanges or wallet providers.

- Examples: Coinbase, Binance, Kraken.

- Security Features: Professional security teams, insurance policies, and regulatory compliance.

- Risks: Users do not control private keys, creating counterparty risk; potential for exchange hacks or insolvency.

Custodial wallets offer ease of use but require trust in the provider.

Non-Custodial Wallets: Full Control and Responsibility

Non-custodial wallets give users sole control over their private keys.

- Examples: Hardware wallets, software wallets like Exodus, Electrum.

- Security Features: User-managed seed phrases, encryption, and backup options.

- Risks: User error can lead to loss; no recovery assistance from third parties.

Non-custodial wallets provide maximum security but demand user diligence.

Best Practices for Backup and Recovery: Ensuring Crypto Wallet Safety

Backing up your wallet and preparing for recovery are critical components of crypto wallet safety.

Seed Phrase Backup Strategies

- Write Down Offline: Always write your seed phrase on paper or durable materials like metal plates.

- Multiple Copies: Store copies in separate secure locations to prevent loss from disasters.

- Avoid Digital Storage: Never save seed phrases in cloud storage, emails, or digital notes to prevent hacking.

Recovery Process

If your wallet or device is lost, stolen, or damaged, the seed phrase allows you to restore access to your funds on any compatible wallet.

- Test Recovery: Before transferring large amounts, test restoring your wallet on a new device to ensure your backup works.

- Keep Seed Phrase Private: Never share your seed phrase with anyone or enter it on untrusted websites.

Advanced Backup Techniques

- Shamir’s Secret Sharing: Splitting seed phrases into multiple parts, requiring a subset to reconstruct, enhancing security.

- Hardware Backup Devices: Specialized devices designed to store seed phrases securely offline.

Emerging Threats to Crypto Wallet Safety: Staying Ahead of Hackers

As technology evolves, so do the tactics of cybercriminals targeting crypto wallets.

Social Engineering Attacks

Hackers manipulate victims into revealing private keys or seed phrases via fake support calls, messages, or impersonation.

Supply Chain Attacks

Malicious actors compromise hardware wallets or software during manufacturing or distribution, embedding vulnerabilities.

Quantum Computing Risks

While still theoretical, quantum computers could potentially break current cryptographic algorithms securing wallets, prompting research into quantum-resistant solutions.

Mobile Device Vulnerabilities

Mobile wallets are susceptible to app vulnerabilities, OS exploits, and malicious apps that can access wallet data.

Legal and Regulatory Considerations Impacting Crypto Wallet Safety

Understanding the legal landscape helps users navigate crypto wallet safety responsibly.

Jurisdictional Regulations

Different countries have varying laws regarding crypto custody, reporting requirements, and investor protections.

- Some jurisdictions require exchanges and custodians to implement stringent security standards.

- Regulations may mandate user identity verification, affecting privacy.

Compliance and User Responsibility

Users must ensure compliance with tax reporting and anti-money laundering laws when managing wallets and transactions.

Insurance and Legal Recourse

Some custodial services offer insurance against hacks, but legal recourse for lost or stolen crypto is limited due to the irreversible nature of blockchain transactions.

User Behavior and Its Impact on Crypto Wallet Safety

Human factors significantly influence wallet security.

Common User Mistakes

- Sharing seed phrases or private keys online or with untrusted parties.

- Falling victim to phishing scams by clicking malicious links.

- Using weak passwords or reusing passwords across platforms.

- Neglecting software updates and security patches.

Educating Users

- Regularly update yourself on security best practices.

- Use official wallet apps and verify download sources.

- Be skeptical of unsolicited communications asking for wallet information.

Psychological Factors

Fear of loss or complexity can lead to poor security choices, such as storing large amounts in hot wallets or neglecting backups.

Comparing Crypto Wallet Safety Features

| Feature | Hot Wallets | Cold Wallets | Custodial Wallets | Non-Custodial Wallets |

|---|---|---|---|---|

| Internet Connectivity | Yes | No | Yes | Yes/No (depends) |

| Private Key Control | User | User | Provider | User |

| Vulnerability to Hacks | High | Low | Medium | Low |

| Ease of Use | High | Medium | Very High | Medium |

| Backup Complexity | Moderate | High | Low | High |

| Recovery Options | Seed phrase | Seed phrase | Provider support | Seed phrase |

| Suitable For | Daily use, trading | Long-term storage | Beginners, traders | Security-conscious |

Strengthening Your Crypto Wallet Safety for the Future

Ensuring crypto wallet safety is essential for protecting your digital assets in today’s rapidly evolving crypto landscape. Whether you use hot wallets for convenience or cold wallets for enhanced security, understanding the risks and adopting best practices can significantly reduce your vulnerability to hacks, scams, and loss.

Conclusion

Crypto wallet safety is vital to protect your digital assets from theft and loss. By choosing the right wallet, securing your private keys, and following expert best practices, you can keep your crypto investments safe and secure. Stay vigilant and prioritize security to confidently navigate the crypto world.