Financial Literacy for Teens: The Missing Lesson

INTRODUCTION

Financial literacy for teens is more than just understanding how to count money or balance a checkbook. It is a vital life skill that equips young people with the knowledge and confidence to navigate the complex financial world they are about to enter. In today’s fast-paced, digital economy, teens face countless financial decisions—from managing allowances and part-time job earnings to understanding credit cards, loans, and online payments. Without proper guidance, these decisions can lead to costly mistakes, debt, and long-term financial stress.

Despite its importance, financial literacy is often overlooked in school curriculums. Many teens graduate without basic money management skills, leaving them vulnerable to poor spending habits, debt traps, and missed opportunities for saving and investing. This gap in education means that young people must seek financial knowledge elsewhere—through family, mentors, or self-study.

Learning financial literacy early empowers teens to take control of their money and their future. It builds a foundation for responsible spending, smart saving, and wise investing. It also fosters independence, critical thinking, and confidence—qualities that extend beyond money and into all areas of life.

This guide will walk you through every essential aspect of financial literacy for teens. From earning your first money to understanding credit, budgeting, saving, investing, and protecting your finances, you will gain practical knowledge and tools to build a strong financial future. Whether you want to avoid common money mistakes or start growing your wealth early, mastering financial literacy as a teen is your first step toward lifelong success.

Why Financial Literacy for Teens Is a Game-Changer

Financial literacy for teens is the foundation for a successful and independent life. Today’s world is filled with financial choices and risks—credit cards, online shopping, digital wallets, peer pressure to spend, and even scams. Without proper knowledge, teens can easily make mistakes that lead to debt, stress, and missed opportunities.

Learning about money early helps teens:

- Make confident and informed financial decisions

- Avoid common money traps and scams

- Build habits that lead to wealth and security

- Gain independence and self-confidence

- Prepare for adult responsibilities like paying bills, renting, or investing

Understanding the Basics: What Is Financial Literacy for Teens?

Financial literacy for teens means knowing how to manage, grow, and protect your money. It includes:

- Earning: Understanding how to make money through jobs, side hustles, or entrepreneurship

- Spending: Making smart choices, knowing the difference between needs and wants, and resisting peer pressure

- Saving: Setting aside money for the future, emergencies, and goals

- Budgeting: Planning and tracking where your money goes every month

- Borrowing: Knowing how loans and credit work, and the dangers of debt

- Investing: Learning how to make your money grow through stocks, mutual funds, or other opportunities

- Protecting: Keeping your money safe from scams, fraud, and financial mistakes

Earning Money: The First Step in Financial Literacy for Teens

Earning is the foundation of financial literacy for teens. Understanding how to earn money teaches responsibility, time management, and the value of hard work.

Ways Teens Can Earn Money

- Part-time jobs: Retail, food service, tutoring, babysitting, delivery, or working in a family business

- Freelancing: Graphic design, writing, coding, photography, or social media management

- Entrepreneurship: Selling handmade crafts, digital products, or offering services like car washing or lawn care

- Online opportunities: Content creation (YouTube, TikTok), affiliate marketing, or online surveys

Building Work Skills

- Learn to write a simple resume and cover letter

- Practice interviewing and communication skills

- Understand workplace etiquette and time management

- Ask for feedback and look for ways to improve

Earning your own money gives you independence and teaches you to respect the effort it takes to make a living.

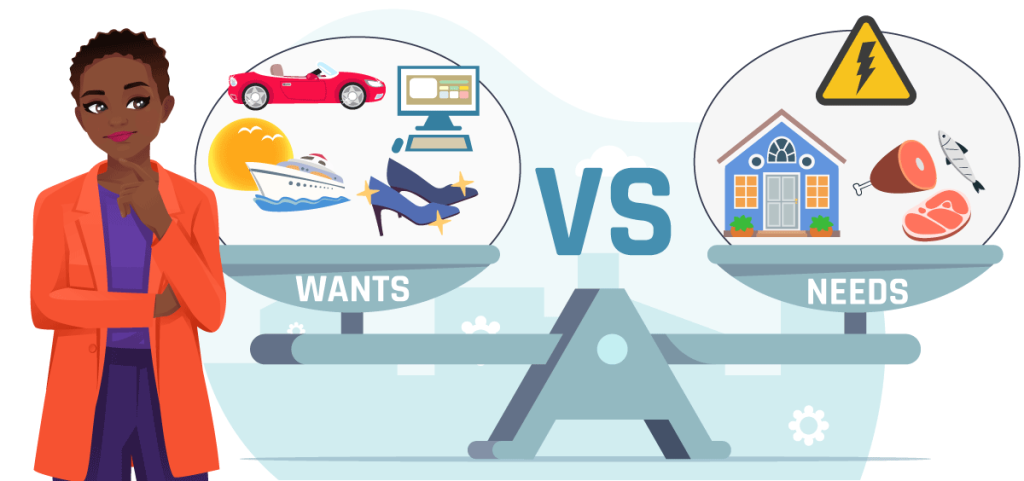

Smart Spending: Needs vs. Wants and Beating Peer Pressure

One of the most important parts of financial literacy for teens is learning to spend wisely. This means knowing the difference between what you need and what you want.

Needs vs. Wants

- Needs: Food, shelter, transportation, school supplies, basic clothing

- Wants: New gadgets, designer clothes, eating out, entertainment subscriptions

How to Spend Wisely

- Make a shopping list before buying anything

- Compare prices and look for deals or discounts

- Ask yourself: “Do I really need this, or do I just want it?”

- Wait 24 hours before making big purchases to avoid impulse buying

Dealing With Peer Pressure

- Set your own money goals and stick to them

- Don’t feel pressured to buy things just because friends have them

- Learn to say “no” politely when you can’t afford something

Smart spending is about making choices that help you reach your goals, not just fit in with others.

Budgeting: The Heart of Financial Literacy for Teens

Budgeting is the process of planning how you will use your money. It helps you avoid overspending and ensures you always have enough for what matters most.

How to Create a Simple Budget

- List your income: Include allowance, job earnings, gifts, or any other sources

- List your expenses: Divide them into fixed (transport, data, school fees) and variable (snacks, outings, shopping)

- Set savings goals: Decide how much you want to save each month

- Allocate spending: Assign money to each category and stick to your plan

Tools for Budgeting

- Use budgeting apps like Mint, YNAB, or a simple spreadsheet

- Keep a money journal to track daily expenses

- Review your budget every month and adjust as needed

Budgeting is a lifelong skill that helps you stay in control and avoid financial stress.

Saving: Building Wealth Starts Early

Saving is a key habit in financial literacy for teens. Even small amounts saved regularly can grow into large sums over time.

Why Save?

- Prepare for emergencies or unexpected expenses

- Reach short-term goals (new phone, school trip)

- Achieve long-term dreams (university, car, travel)

- Gain peace of mind and independence

How to Save Effectively

- Open a savings account with a parent or guardian

- Set specific goals and track your progress

- Use the “pay yourself first” method: Save a portion of your income before spending

- Avoid dipping into your savings for non-essentials

Understanding Interest

- Learn about compound interest and how your money can grow faster over time

- Compare savings accounts and choose one with the best interest rate

Saving is not about how much you earn, but how much you keep.

Credit and Debt: What Every Teen Should Know

Credit and debt are important topics in financial literacy for teens. Used wisely, credit can help you in emergencies or big purchases. Used carelessly, it can lead to serious problems.

Understanding Credit

- Credit: Borrowing money you must pay back, usually with interest

- Credit cards: Convenient but risky if you don’t pay off the balance every month

- Loans: Should be used only for important needs, like education or emergencies

Dangers of Debt

- High interest rates can make debt grow quickly

- Late payments hurt your credit score and future opportunities

- Borrowing for wants (not needs) leads to money problems

Building Good Credit

- Pay bills and loans on time, every time

- Only borrow what you can afford to repay

- Check your credit report regularly for errors

Learning about credit now helps you avoid debt traps in the future.

Investing: Making Your Money Work for You

Investing is an advanced part of financial literacy for teens, but starting early can make a big difference. Investing means using your money to buy assets (like stocks or mutual funds) that can grow in value over time.

Why Invest as a Teen?

- The earlier you start, the more your money can grow due to compound interest

- Learn about risk and reward before making big decisions

- Build wealth for future goals, like university or starting a business

How to Start Investing

- Learn the basics: What are stocks, bonds, and mutual funds?

- Start small with the help of a parent or guardian

- Use apps or platforms designed for beginners

- Never invest in something you don’t understand

Investing is about patience and learning, not quick wins.

Protecting Your Money: Security and Insurance

Financial literacy for teens also means knowing how to keep your money safe from theft, fraud, and accidents.

Money Security Tips

- Never share your bank PINs or passwords with anyone

- Use strong passwords for online banking and shopping

- Be careful with online deals that seem too good to be true

- Shred old bank statements and keep your financial documents safe

Understanding Insurance

- Health insurance: Helps pay for medical bills

- Property insurance: Protects your belongings from theft or damage

- Life insurance: Supports your family if something happens to you

Insurance may seem boring, but it can save you from big financial losses.

Real-Life Experience: Learning by Doing

The best way to build financial literacy for teens is through real-life practice.

- Open and manage a bank account with your parents’ help

- Try earning your own money through part-time work or small businesses

- Help your family with budgeting and bill payments

- Volunteer for school projects that involve fundraising or managing money

- Ask parents or mentors to share their financial successes and mistakes

Experience is the best teacher when it comes to money.

Digital Money Skills: Staying Smart in a Cashless World

Modern financial literacy for teens includes understanding digital money and online safety.

Using Digital Tools

- Learn to use mobile banking apps for checking balances and making transfers

- Use digital wallets (like Apple Pay or Google Pay) safely

- Shop online only from trusted websites

Avoiding Online Scams

- Never click on suspicious links or share personal information online

- Be cautious with online “investment” offers that promise big returns

- Report any suspicious activity to your bank or a trusted adult

Digital skills are now part of everyday money management.

Giving Back: The Role of Charity and Community

Financial literacy for teens isn’t just about personal gain. It’s also about understanding the value of giving and helping others.

- Set aside a small part of your money for charity or community projects

- Volunteer your time or skills to help others

- Learn about social entrepreneurship and how businesses can make a positive impact

Giving back builds character and teaches you the true value of money.

Common Financial Mistakes Teens Make and How to Avoid Them

- Spending all your money as soon as you get it

- Ignoring the importance of budgeting and saving

- Taking on debt for things you don’t need

- Falling for scams or “get rich quick” schemes

- Not asking for help or advice when needed

Learning from mistakes is part of financial literacy for teens.

Key Skills in Financial Literacy for Teens

| Skill | What to Do | Why It Matters |

|---|---|---|

| Earning | Find jobs or gigs, value your time | Builds independence |

| Spending | Prioritize needs, avoid impulse buying | Prevents wasteful spending |

| Budgeting | Track income and expenses | Keeps you in control |

| Saving | Set goals, use a savings account | Prepares for emergencies/goals |

| Borrowing | Learn about loans, credit, and interest | Avoids debt traps |

| Investing | Start small, learn basics | Grows your money over time |

| Protecting Money | Use security, avoid scams, get insurance | Keeps your finances safe |

| Digital Skills | Use apps, online banking, avoid scams | Stay safe in a cashless world |

| Giving Back | Donate, volunteer, help others | Builds character and empathy |

Realife Case Studies

Case Study 1: Access Bank’s Youth Financial Literacy Initiative in Nigeria

Access Bank Plc, in partnership with organizations like 9ijakids and Kidpreneur Africa, has empowered over 83,500 children and teens across Nigeria and several African countries with essential financial management skills. Through engaging talks, interactive games, and educational resources distributed in over 250 schools, students learned about budgeting, saving, and entrepreneurship.

A notable example is Blessing Collins, a student at Aguda Senior Grammar School, who shared how the training from Access Bank inspired her to start selling coconut chips to support her education. The initiative not only provided practical money skills but also encouraged financial independence and entrepreneurship among young people. Access Bank further supports financial inclusion by helping set up financial literacy clubs in schools, aiming to foster a sustainable economy and secure the financial future of the next generation.

Case Study 2: Helping a Teen Set and Achieve Financial Goals

A high school junior, planning to attend college, sought help from a financial counselor to create a personal spending plan. The teen worked 15 hours a week at $10 per hour, earning about $700 monthly, with additional income from babysitting and a small allowance. Required monthly expenses included $50 for gasoline and $80 for car insurance, while parents covered all other costs.

The counselor worked with the teen to balance saving for college, spending on entertainment and clothing, and donating to charity. By setting clear goals and tracking spending, the student learned how to allocate income wisely: setting aside a portion for savings, budgeting for fun, and regularly giving to charity. This practical approach helped the teen develop lifelong money management habits, preparing for both immediate needs and future responsibilities.

Case Study 3: EquipHER—Boosting Financial Literacy and Inclusion for Young Women

NGX Regulation Limited (NGX RegCo), as part of the Nigerian Exchange Group, launched the EquipHER initiative to close the gender gap in financial inclusion. In 2023, only 47% of Nigerian women accessed formal financial services compared to 58% of men. EquipHER focused on digital and financial literacy, encouraging young women to confidently participate in Nigeria’s capital markets.

Through targeted policies, workshops, and stakeholder collaboration, NGX RegCo increased the number of active women investors by 11.5%. The initiative addressed cultural and educational barriers, providing young women with the knowledge and tools to invest and manage their finances. This case demonstrates how focused financial literacy programs can empower teens and young adults, especially girls, to take control of their economic future and participate fully in the financial system.

Quotes

- “Financial literacy for teens is not just about money. It’s about freedom, choices, and building the life you want.”

- “Learning about money as a teen is like planting a tree early. The sooner you start, the bigger and stronger it grows.”

- “The best investment you can make is in your own financial education.”

Highlighted Points from the Article

- Financial literacy for teens is a critical life skill that empowers young people to make smart decisions about money, yet most schools do not teach it.

- Understanding the basics—earning, spending, saving, budgeting, borrowing, investing, and protecting money—is essential for every teen.

- Earning money teaches responsibility and independence, whether through part-time jobs, freelancing, or entrepreneurship.

- Smart spending means knowing the difference between needs and wants and resisting peer pressure to overspend.

- Budgeting is the foundation of good money management, helping teens track income, control expenses, and plan for the future.

- Saving early, even in small amounts, builds wealth and financial security through the power of compound interest.

- Credit and debt can be helpful but are risky if mismanaged; understanding interest rates and credit scores is crucial.

- Investing is a way to grow money over time, and starting young gives teens a major advantage.

- Protecting your money involves digital safety and understanding insurance, keeping finances secure from scams and accidents.

- Real-life experience, such as managing a bank account or participating in family budgeting, is the best way for teens to learn financial skills.

- Digital money skills are essential in today’s cashless world, including using banking apps and avoiding online scams.

- Giving back through charity or community service teaches empathy and the true value of money.

- Common mistakes to avoid include spending all income, ignoring budgeting, taking on unnecessary debt, and falling for scams.

- Financial literacy for teens is a superpower for life, providing the foundation for independence, confidence, and long-term success.

Frequently Asked Questions

Why don’t schools teach financial literacy for teens?

Many schools focus on traditional subjects and may lack resources or trained teachers for personal finance. Parents, online courses, and community programs can help fill this gap.

How can I start learning about money as a teen?

Begin by tracking your spending, setting a budget, opening a savings account, and asking adults for advice. Use free online resources for extra learning.

What is the best way to save money as a teen?

Set clear goals, save a portion of all income, and avoid spending on unnecessary items. Use a bank account to keep your savings safe.

How can I avoid debt as a teen?

Only borrow for important needs, pay back loans on time, and avoid using credit for wants. Learn about interest rates and read all terms before borrowing.

Conclusion

Financial literacy for teens is the missing lesson that can change your life. By learning how to earn, spend, save, budget, invest, and protect your money, you build a foundation for a successful future. The earlier you start, the more prepared you’ll be for any financial challenge or opportunity. Make financial literacy for teens your secret weapon for a brighter, more secure tomorrow.