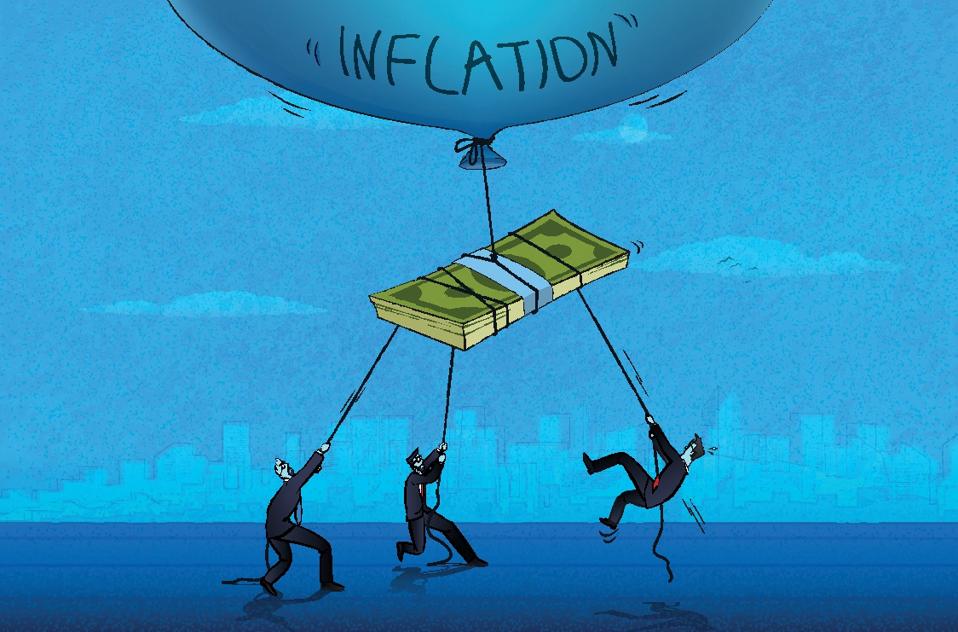

7 Ways Inflation Is Quietly Eating Your Salary

Introduction

Inflation eating salary is a hidden but serious challenge affecting workers worldwide in 2025. Even if your paycheck increases nominally, inflation can reduce its real value, quietly eroding your purchasing power and financial security. This comprehensive guide explains 7 powerful ways inflation is quietly eating your salary, supported by case studies, data, and practical advice to help you safeguard your income.

Understanding Inflation Eating Salary: What It Means for Your Finances

Inflation eating salary means that rising prices for goods and services reduce the actual value of your earnings. While your nominal salary might increase, if it doesn’t keep pace with inflation, your real income declines.

Real Wage vs Nominal Wage

| Year | Nominal Salary | Inflation Rate | Real Salary (Adjusted) |

|---|---|---|---|

| 2023 | $50,000 | 3% | $50,000 |

| 2024 | $52,000 | 7% | $48,600 |

| 2025 | $54,000 | 10% | $49,090 |

Note: Despite nominal increases, real salary decreases when inflation outpaces wage growth.

1. Declining Purchasing Power Reduces Your Salary’s Value

Inflation causes prices of essentials—food, housing, transportation—to rise faster than wages, shrinking your purchasing power.

Case Study: Sarah’s Monthly Budget Squeeze

Sarah’s monthly expenses rose from $2,000 in 2023 to $2,400 in 2025 due to inflation, but her salary only increased from $3,000 to $3,100. Her disposable income shrank, forcing cuts in savings and discretionary spending.

2. Wage Growth Often Lags Behind Inflation

Many employers do not increase wages proportionally to inflation, leading to a real income decline.

- In 2021-2022, inflation surged beyond wage increases globally.

- Companies froze or limited raises amid economic uncertainty.

- Salary budgets in 2025 are projected to increase about 3.7%-3.8%, slightly above current inflation (~2.4%) but still lagging behind past inflation spikes.

3. Rising Costs of Non-Discretionary Expenses

Costs for healthcare, education, and transportation often rise faster than general inflation, disproportionately impacting your budget.

| Expense Category | Inflation Rate (2023-2025) | Impact on Salary (%) |

|---|---|---|

| Healthcare | 12% | High |

| Education | 15% | High |

| Transportation | 10% | Moderate |

| Food & Groceries | 8% | Moderate |

4. Inflation Erodes Your Savings and Retirement Contributions

If your salary doesn’t keep pace with inflation, the amount you can save or invest shrinks, affecting long-term financial security.

| Year | Savings Amount | Inflation Rate | Real Value of Savings |

|---|---|---|---|

| 2023 | $10,000 | 3% | $10,000 |

| 2024 | $12,000 | 7% | $11,215 |

| 2025 | $14,000 | 10% | $12,727 |

5. Psychological Impact: Salary Dissatisfaction and Stress

Inflation eating salary causes financial stress, lowering morale and productivity.

Case Study: Corporate Response to Inflation Stress

Companies like Starbucks and Unilever reported increased employee turnover linked to stagnant wages amid rising costs. They introduced flexible pay and wellness programs to retain staff.

6. Increased Debt Burden as Costs Rise

When salaries lag inflation, workers may rely more on credit cards and loans, increasing debt and interest payments.

| Debt Type | Average Interest Rate | Inflation Impact on Debt |

|---|---|---|

| Credit Cards | 15-25% | Higher real cost if payments increase |

| Personal Loans | 8-12% | Debt consumes larger income share |

| Mortgages | 4-7% | Variable rates may rise with inflation |

7. Reduced Ability to Negotiate Fair Salary Increases

High inflation complicates salary negotiations as companies balance cost pressures with employee demands.

How to Negotiate Salary Adjustments Amid Inflation

Learn effective negotiation techniques to secure raises that match or exceed inflation.

Budgeting Tips to Combat Inflation’s Impact

Adjust your spending and savings to maintain financial stability.

Investing to Outpace Inflation

Explore investment options that preserve and grow your income’s purchasing power.

2025 Salary Budget Projections and Inflation

Recent surveys show that the average salary budget increase projected for 2025 is about 3.8%, slightly above the current inflation rate of 2.4%. However, inflation spikes in previous years outpaced wage growth, causing real income declines.

| Year | Average Salary Budget Increase | Inflation Rate | Notes |

|---|---|---|---|

| 2021 | 3.0% | 5.5% | Inflation outpaced wage growth |

| 2022 | 3.2% | 7.0% | Significant real wage decline |

| 2023 | 3.5% | 4.5% | Partial catch-up, still lagging |

| 2024 | 3.8% | 3.0% | Closer alignment, but cautious |

Case Study: Mid-Sized Tech Firm’s Wage Adjustment

A mid-sized tech firm gave a 3% raise in 2022 while inflation was 7%. Employees felt the pinch as real income dropped, leading to higher turnover. The company responded by increasing wages by 5% in 2025 to restore purchasing power.

Wage Growth vs Inflation: Latest Trends

Wage growth varies by sector and region, with some industries faring better than others in combating inflation eating salary.

| Sector | Nominal Wage Growth (2024-2025) | Inflation Rate | Real Wage Growth |

|---|---|---|---|

| Leisure & Hospitality | 5.0% | 2.4% | 2.6% |

| Information Technology | 3.0% | 2.4% | 0.6% |

| Manufacturing | 3.5% | 2.4% | 1.1% |

Unionized workers generally experience higher wage increases, helping offset inflation better than non-union workers.

Psychological and Financial Impact of Inflation Eating Salary

Inflation eating salary causes stress and anxiety, affecting employee morale and productivity.

Tips for Negotiating Raises Amid Inflation

- Present data on inflation’s impact on living costs.

- Highlight personal contributions and market salary benchmarks.

- Consider alternative benefits if salary increases are limited.

How Inflation Eating Salary Affects Different Demographics

Inflation does not impact all workers equally. Some groups are more vulnerable to its effects.

Low-Income Workers

Low-income earners spend a larger portion of their income on essentials, making inflation eating salary especially damaging.

Young Professionals

Often early in their careers with lower salaries, young professionals may struggle more to keep up with rising costs.

Retirees and Fixed-Income Individuals

Those on fixed incomes face shrinking purchasing power as inflation rises, with limited ability to increase income.

Inflation Eating Salary and Its Impact on Savings and Retirement Planning

Inflation reduces the real value of savings and retirement funds if returns do not outpace inflation.

The Challenge of Maintaining Retirement Purchasing Power

Workers need to save more or invest wisely to protect their future income against inflation’s eroding effects.

Practical Strategies to Protect Your Salary from Inflation

Budgeting Adjustments

- Track expenses and prioritize essentials.

- Cut discretionary spending temporarily.

Investing Wisely

- Consider inflation-protected securities.

- Diversify portfolios for growth potential.

Building Emergency Funds

- Maintain a cash buffer for inflation-driven expenses.

Upskilling and Career Development

- Enhance skills to increase earning potential and negotiate better wages.

Government and Employer Responses to Inflation Eating Salary

Policy Measures

- Some governments adjust minimum wage laws to reflect inflation.

- Tax reliefs and subsidies target vulnerable populations.

Employer Initiatives

- Flexible pay structures.

- Cost-of-living adjustments.

- Employee assistance programs.

How Inflation Eating Salary Influences Consumer Behavior

Inflation eating salary doesn’t just affect your wallet—it changes how you shop, save, and spend money.

Shift Toward Essential Purchases

As prices rise, consumers tend to cut back on luxury and non-essential items, focusing more on necessities. This behavioral shift impacts businesses and the overall economy.

Increased Price Sensitivity

Consumers become more price-conscious, seeking discounts, switching brands, or buying in bulk to stretch their income.

Delayed Major Purchases

High inflation often leads to postponing big-ticket purchases like cars, homes, or appliances, affecting industries reliant on consumer spending.

The Role of Inflation Expectations in Salary Negotiations

How people perceive future inflation can influence their wage demands and negotiations.

Inflation Expectations Drive Wage Demands

If workers expect inflation to rise, they may push harder for higher raises to maintain purchasing power.

Employer Responses to Inflation Expectations

Businesses may proactively adjust wages or benefits to retain talent during periods of anticipated inflation spikes.

Inflation Eating Salary and Its Impact on Household Financial Planning

Inflation complicates household budgeting and long-term financial goals.

Adjusting Budgets Regularly

Households need to review and adjust budgets frequently to account for changing prices.

Reassessing Financial Goals

Inflation may require revising savings targets, retirement plans, and debt repayment schedules.

Case Study: The Johnson Family’s Financial Adjustment

The Johnsons increased their monthly grocery and utility budget by 15% in 2024 due to inflation, delaying home renovations and vacations to stay financially stable.

How Inflation Eating Salary Affects Small Business Owners and Entrepreneurs

Small business owners often face unique challenges as inflation impacts both their personal income and business costs.

Rising Operational Costs

Inflation increases expenses for supplies, rent, and wages, squeezing profit margins.

Difficulty Passing Costs to Customers

Competitive markets may limit the ability to raise prices without losing customers.

Impact on Owner’s Draw and Personal Salary

Business owners may have to reduce their personal income to keep the business afloat.

The Connection Between Inflation Eating Salary and Mental Health

Financial stress from shrinking income can significantly affect mental well-being.

Anxiety and Depression

Worry about making ends meet can lead to anxiety and depression.

Impact on Work Performance

Stress related to financial insecurity can reduce focus and productivity.

Coping Strategies

Seeking financial counseling, stress management techniques, and support networks can help mitigate these effects.

How Technology Can Help Combat Inflation Eating Salary

Modern tools offer ways to manage finances better amid inflation.

Budgeting Apps

Apps like Mint, YNAB, or PocketGuard help track spending and identify savings opportunities.

Price Comparison Tools

Online tools allow consumers to compare prices and find the best deals.

Automated Savings

Technology can automate savings transfers to build emergency funds or investment accounts.

Inflation Eating Salary: The Global Perspective

Inflation and its impact on salaries vary worldwide, influenced by economic policies and market conditions.

| Region | Average Inflation Rate (2024) | Average Wage Growth | Key Challenges |

|---|---|---|---|

| North America | 3.0% | 3.5% | Balancing wage growth with inflation |

| Europe | 2.5% | 2.0% | Energy prices driving inflation |

| Asia-Pacific | 4.0% | 5.0% | Supply chain disruptions |

| Latin America | 8.0% | 6.0% | Currency volatility and inflation |

Preparing for Future Inflation: Long-Term Financial Strategies

Planning ahead can reduce the impact of inflation eating salary over time.

Diversify Income Sources

Side hustles, freelance work, or passive income can supplement wages.

Invest in Inflation-Protected Assets

Consider real estate, commodities, or inflation-indexed bonds.

Continuous Skill Development

Enhancing skills increases employability and bargaining power.

Conclusion

Inflation eating salary is a real threat to your financial health in 2025. Understanding how inflation erodes your income and adopting proactive strategies can help you protect your purchasing power and secure your financial future.