Central Bank Digital Currencies: Ultimate Government Guide

How Digital Money is Reshaping Government Finance Worldwide

Central bank digital currencies are taking the world by storm! From China’s digital yuan to Europe’s digital euro, governments everywhere are racing to create their own digital money. But why this sudden rush? What’s driving world leaders to abandon traditional cash for digital alternatives? Let’s dive into this fascinating world where technology meets government policy, and discover why central bank digital currencies are becoming the hottest topic in global finance!

What Are Central Bank Digital Currencies?

Think of central bank digital currencies (CBDCs) as the government’s answer to Bitcoin and other cryptocurrencies. Unlike Bitcoin, which operates independently, CBDCs are created and controlled by central banks – the same institutions that print your regular money.

Imagine having digital dollars in your phone that work exactly like cash, but faster, cheaper, and more secure. That’s essentially what central bank digital currencies promise to deliver. They’re like having a bank account directly with the government, cutting out traditional banks as middlemen.

Fun Fact: CBDCs aren’t just digital versions of existing money – they’re entirely new forms of currency that could revolutionize how we think about money itself!

The Great Digital Money Race: Who’s Leading?

The race to launch central bank digital currencies is heating up worldwide. Here’s who’s leading the pack:

China: The Digital Yuan Pioneer

China launched its digital yuan (e-CNY) in 2020 and has been testing it in major cities. They’re not just testing – they’re going full speed ahead! The Chinese government has distributed millions of digital yuan to citizens through lottery systems and encouraged businesses to accept it.

European Union: The Digital Euro Project

The European Central Bank is working on a digital euro that could serve 340 million Europeans. They’re taking a careful, methodical approach, conducting extensive research and public consultations.

United States: The Digital Dollar Debate

The US Federal Reserve is studying CBDCs but hasn’t committed to launching one yet. They’re being extra cautious, wanting to get it right rather than being first.

Other Notable Players:

- Nigeria: Launched the eNaira in 2021

- Jamaica: Testing the JAM-DEX

- India: Piloting the digital rupee

- Sweden: Exploring the e-krona

Why Are Governments So Excited About Central Bank Digital Currencies?

The rush to create central bank digital currencies isn’t just about keeping up with technology trends. Governments have compelling reasons to go digital:

1. Fighting the Decline of Cash

Cash usage is plummeting worldwide. In Sweden, cash transactions make up less than 1% of all payments! Governments worry about losing control over their monetary systems as people switch to private digital payment methods.

2. Competing with Cryptocurrencies

Bitcoin and other cryptocurrencies are gaining popularity, potentially threatening government control over money. Central bank digital currencies offer a way to provide digital convenience while maintaining government oversight.

3. Financial Inclusion Magic

CBDCs can help bring banking services to the unbanked. Imagine someone in a remote village accessing government financial services through just a basic smartphone – that’s the power of central bank digital currencies!

4. Reducing Costs and Increasing Efficiency

Digital transactions are cheaper than handling physical cash. No more printing, storing, or transporting money. CBDCs could save governments billions of dollars annually.

5. Better Monetary Policy Control

With central bank digital currencies, governments can implement monetary policies more effectively. They can track money flow in real-time and respond to economic changes faster.

The CBDC Comparison Table: Different Approaches Worldwide

| Country | CBDC Name | Status | Key Features | Target Launch |

|---|---|---|---|---|

| China | Digital Yuan (e-CNY) | Live Testing | Offline payments, government control | Already launched |

| European Union | Digital Euro | Research Phase | Privacy-focused, cash-like features | 2026-2028 |

| United States | Digital Dollar | Study Phase | Undecided approach | No timeline |

| Nigeria | eNaira | Launched | Mobile-first, financial inclusion | Launched 2021 |

| India | Digital Rupee | Pilot Testing | Wholesale and retail versions | Testing phase |

| Sweden | e-Krona | Research | Offline capability, user-friendly | Under review |

The Amazing Benefits of Central Bank Digital Currencies

Central bank digital currencies promise to transform how we use money. Here are the exciting benefits:

Lightning-Fast Payments

Imagine sending money to anyone, anywhere, instantly – even on weekends and holidays! CBDCs could make this reality. No more waiting days for bank transfers or paying hefty fees for international transactions.

Enhanced Security

Government-backed digital currencies come with robust security features. Unlike private cryptocurrencies that can be hacked or lost, central bank digital currencies offer government-level protection for your money.

Financial Inclusion Revolution

CBDCs could bring financial services to the 1.7 billion people worldwide who don’t have bank accounts. All they need is a basic smartphone to access government financial services directly.

Reduced Crime and Corruption

Digital transactions leave trails that make it harder for criminals to launder money or evade taxes. Central bank digital currencies could significantly reduce financial crimes.

Economic Stimulus Precision

During economic crises, governments could distribute stimulus payments instantly and directly to citizens through CBDCs, ensuring help reaches those who need it most.

The Challenges and Concerns: It’s Not All Sunshine and Rainbows

While central bank digital currencies offer exciting possibilities, they also raise important concerns:

Privacy Worries

CBDCs could give governments unprecedented visibility into citizens’ spending habits. Every transaction could be tracked and monitored, raising serious privacy concerns.

Banking System Disruption

If everyone moves their money to CBDCs, traditional banks could face serious challenges. This could disrupt the entire financial system in unexpected ways.

Technical Challenges

Building a CBDC system that can handle millions of transactions per second while remaining secure is incredibly complex. Technical failures could have catastrophic consequences.

Cybersecurity Risks

CBDCs would become attractive targets for hackers and cybercriminals. A successful attack on a CBDC system could affect an entire nation’s economy.

Digital Divide Issues

Not everyone has access to smartphones or reliable internet. CBDCs could exclude those who can’t access digital technology.

Top 10 Reasons Governments Love Central Bank Digital Currencies

- Complete monetary control – Track every transaction in real-time

- Instant policy implementation – Change interest rates or distribute money immediately

- Reduced operational costs – No more printing, storing, or transporting cash

- Enhanced tax collection – Harder to evade taxes with digital trails

- Financial inclusion – Bring banking to the unbanked

- Reduced crime – Digital trails make illegal activities harder

- Economic data – Real-time insights into economic activity

- Crisis response – Distribute emergency funds instantly

- International competitiveness – Keep up with other nations

- Future-proofing – Prepare for an increasingly digital world

How Central Bank Digital Currencies Could Change Your Daily Life

The impact of central bank digital currencies on everyday life could be revolutionary:

Morning Coffee

Instead of fumbling for cash or cards, you’d simply tap your phone to pay for coffee. The payment would be instant, secure, and potentially free of transaction fees.

Paying Bills

Utility bills, rent, and other payments could be automated through CBDCs, with smart contracts ensuring payments are made on time and at the best rates.

Receiving Salary

Your employer could pay your salary directly to your CBDC wallet, eliminating the need for traditional bank accounts and reducing payroll processing time.

International Travel

CBDCs could make international travel easier by providing instant currency conversion and eliminating the need to carry cash or worry about exchange rates.

Emergency Situations

During natural disasters or emergencies, governments could instantly distribute aid through CBDCs, ensuring help reaches affected people quickly.

The Technology Behind Central Bank Digital Currencies

Central bank digital currencies rely on cutting-edge technology to function:

Blockchain Technology

Many CBDCs use blockchain technology to ensure security and transparency. However, unlike Bitcoin’s public blockchain, CBDC blockchains are typically controlled by central banks.

Digital Wallets

Users would access CBDCs through digital wallets on their smartphones or computers. These wallets would be more secure than current payment apps because they’re backed by government guarantees.

Offline Functionality

Some CBDCs are designed to work even without internet connectivity, ensuring payments can be made anywhere, anytime.

Smart Contracts

CBDCs could incorporate smart contracts that automatically execute transactions when certain conditions are met, making payments more efficient and reducing errors.

Global Impact: How Central Bank Digital Currencies Could Reshape the World Economy

The widespread adoption of central bank digital currencies could have profound global effects:

International Trade Revolution

CBDCs could make international trade faster and cheaper by eliminating the need for correspondent banking relationships and reducing settlement times from days to minutes.

Reduced Dollar Dominance

Currently, the US dollar dominates international trade. CBDCs could allow other countries to conduct trade in their own digital currencies, potentially reducing dollar dependence.

Enhanced Financial Stability

CBDCs could provide central banks with better tools to monitor and respond to financial crises, potentially making the global financial system more stable.

New Forms of Economic Cooperation

Countries could develop interoperable CBDCs that work seamlessly across borders, creating new forms of economic integration and cooperation.

The Future Timeline: When Will Central Bank Digital Currencies Become Reality?

The rollout of central bank digital currencies is happening at different speeds worldwide:

2024-2025: Early Adopters

- China continues expanding digital yuan usage

- Nigeria improves eNaira adoption

- More pilot programs launch globally

2026-2028: Major Economies Join

- European Union likely launches digital euro

- India may fully deploy digital rupee

- Several smaller countries launch CBDCs

2029-2032: Widespread Adoption

- United States may finally launch digital dollar

- Most developed countries have CBDCs

- International interoperability develops

2033 and Beyond: The New Normal

- CBDCs become standard globally

- Cash usage drops to minimal levels

- New economic models emerge

What This Means for You: Preparing for the CBDC Future

As central bank digital currencies become reality, here’s how to prepare:

Stay Informed

Keep up with CBDC developments in your country. Understanding the changes will help you adapt more easily.

Embrace Digital Payments

Start using digital payment methods now to get comfortable with cashless transactions.

Understand Privacy Implications

Learn about the privacy features (or lack thereof) in your country’s planned CBDC.

Maintain Financial Diversity

Don’t put all your eggs in one basket. Maintain diverse financial assets and payment methods.

Develop Digital Skills

Improve your digital literacy to navigate the increasingly digital financial landscape.

The Resistance: Why Some People Oppose Central Bank Digital Currencies

Not everyone is excited about central bank digital currencies. Here’s why some people are concerned:

Privacy Advocates

They worry that CBDCs will create a surveillance state where governments can monitor every purchase.

Cryptocurrency Enthusiasts

They prefer decentralized cryptocurrencies over government-controlled digital money.

Traditional Banking Supporters

They fear CBDCs will disrupt the banking system and reduce financial innovation.

Digital Skeptics

They prefer physical cash and worry about technical failures or cyber attacks.

Civil Liberties Groups

They’re concerned about government overreach and the potential for financial censorship.

Success Stories: Countries Getting Central Bank Digital Currencies Right

Several countries are showing how central bank digital currencies can work effectively:

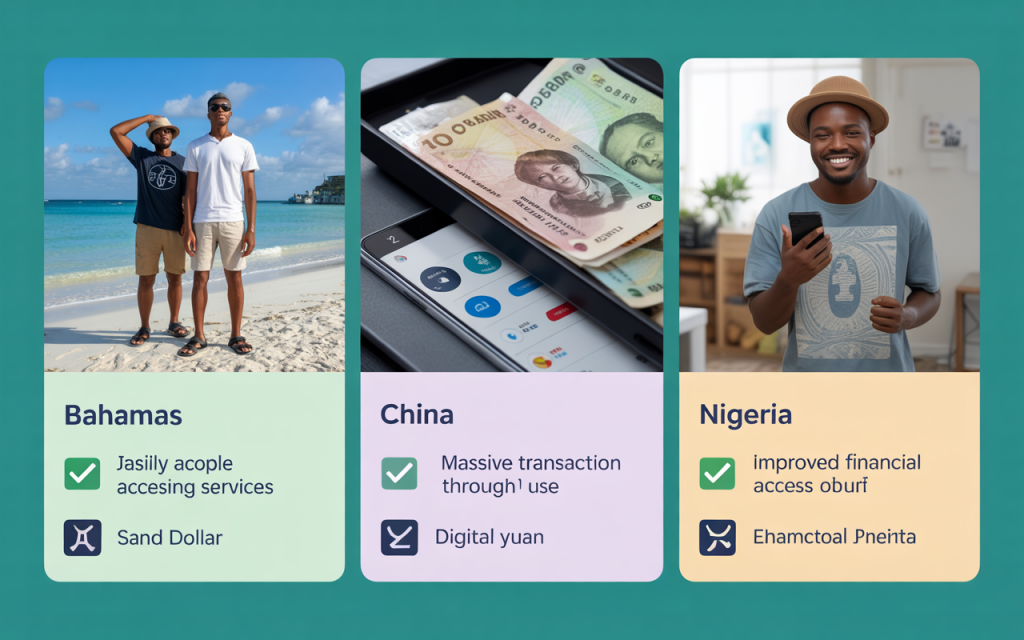

The Bahamas: Sand Dollar Success

The Bahamas successfully launched the Sand Dollar, making it easier for people on remote islands to access financial services.

China: Digital Yuan Momentum

China’s digital yuan has processed billions of dollars in transactions, showing that large-scale CBDC implementation is possible.

Nigeria: eNaira Innovation

Despite initial challenges, Nigeria’s eNaira is helping bring financial services to previously underserved populations.

The Economic Implications: How Central Bank Digital Currencies Could Affect Markets

Central bank digital currencies could have significant economic impacts:

Interest Rate Policy

CBDCs could make monetary policy more effective by allowing central banks to implement negative interest rates or provide direct stimulus to citizens.

Banking Sector Transformation

Traditional banks may need to reinvent themselves as CBDCs reduce demand for traditional banking services.

Payment Industry Disruption

Credit card companies and payment processors may face reduced demand as CBDCs provide free or low-cost payment alternatives.

Investment Opportunities

New industries and investment opportunities will emerge around CBDC technology and services.

Environmental Considerations: Are Central Bank Digital Currencies Green?

Unlike energy-intensive cryptocurrencies like Bitcoin, most central bank digital currencies are designed to be environmentally friendly:

Lower Energy Consumption

CBDCs typically use less energy than traditional banking systems and much less than Bitcoin mining.

Reduced Physical Infrastructure

Digital currencies require fewer physical bank branches and ATMs, reducing environmental impact.

Paperless Transactions

CBDCs eliminate the need for paper receipts and statements, reducing paper waste.

Efficient Government Operations

Digital currencies can make government operations more efficient, reducing overall resource consumption.

The Social Impact: How Central Bank Digital Currencies Could Change Society

Central bank digital currencies could have profound social implications:

Reduced Inequality

CBDCs could provide equal access to financial services regardless of income or location.

Enhanced Government Services

Governments could deliver services more efficiently through CBDC systems.

Changed Consumer Behavior

Digital-native payment systems could change how people think about and use money.

New Forms of Social Interaction

CBDCs could enable new types of social and economic interactions that aren’t possible with traditional money.

Conclusion: The Digital Money Revolution Is Here!

The rush to launch central bank digital currencies represents one of the most significant changes in monetary history. Governments worldwide are recognizing that the future of money is digital, and they want to be part of shaping that future rather than being left behind.

While central bank digital currencies offer exciting benefits like instant payments, financial inclusion, and enhanced security, they also raise important questions about privacy, government control, and the future of traditional banking.

As we stand on the brink of this digital money revolution, one thing is clear: central bank digital currencies are not just a technological upgrade – they’re a fundamental reimagining of how money works in the digital age. Whether you’re excited about the possibilities or concerned about the implications, it’s important to stay informed and engaged as this transformation unfolds. The decisions made today about central bank digital currencies will shape the financial landscape for generations to come.