Stablecoins Explained: Ultimate Guide to Crypto Stability

Understanding Digital Currency Stability in Today's Crypto Market

What Are Stablecoins?

Stablecoins are cryptocurrencies whose value is tied to another asset, such as the US dollar or gold1. The main idea behind stablecoins is to provide an alternative to the high volatility of popular cryptocurrencies, making them potentially more suitable for everyday transactions2. When you own a stablecoin, you should be able to trust that its value will not change dramatically from day to day.

Think of stablecoins as digital versions of regular money. If you have a US dollar stablecoin, it should always be worth about one US dollar. This makes stablecoins useful for people who want to use cryptocurrency without worrying about losing money due to price changes.

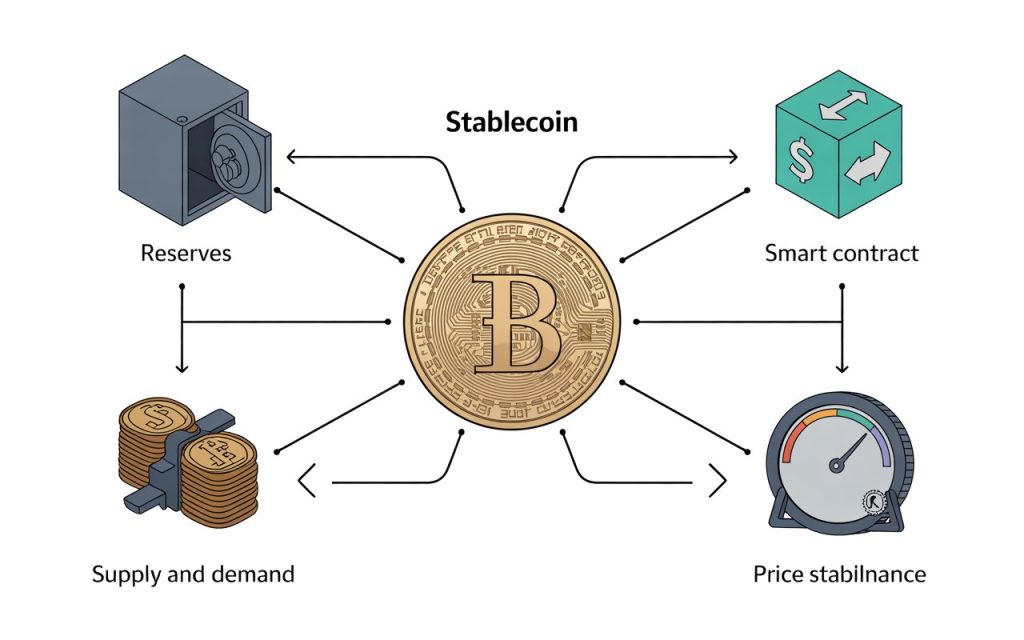

How Do Stablecoins Work?

Stablecoins maintain their value through different methods. The most common way is by keeping reserves of other assets, like US dollars or gold, to back up the stablecoin3. For example, if a company creates one million stablecoins, they should keep one million US dollars in a bank account to support those coins.

Some stablecoins use smart contracts and algorithms to control their supply and demand1. When the price goes up, more coins are created. When the price goes down, coins are removed from circulation. This automatic system tries to keep the price stable.

Types of Stablecoins

There are several different types of stablecoins, each with its own way of staying stable:

Fiat-Collateralized Stablecoins

These stablecoins are backed by regular government money like US dollars or euros. The company that creates the stablecoin keeps the same amount of real money in a bank account. Popular examples include Tether (USDT) and USD Coin (USDC). These are the most common type of stablecoins because they are easier to understand and trust.

Commodity-Backed Stablecoins

These stablecoins are tied to the price of valuable items like gold, silver, or oil. For example, Tether Gold (XAUT) is backed by real gold stored in a safe place. When you own this type of stablecoin, you own a piece of the valuable item behind it.

Crypto-Collateralized Stablecoins

These stablecoins are backed by other cryptocurrencies. Because cryptocurrencies can be very volatile, these stablecoins usually need more backing than their value. For example, to create $1 worth of stablecoin, they might need $1.50 worth of other cryptocurrencies. DAI is a popular example of this type of stablecoin.

Algorithmic Stablecoins

These stablecoins use computer programs to control their supply and keep their price stable. They do not need backing assets but rely on complex algorithms and market forces. However, these have proven to be risky, as seen with the collapse of TerraUSD (UST) in 2022.

Benefits of Stablecoins

Stablecoins offer many advantages that make them popular among crypto users:

Price Stability

The main benefit of stablecoins is that they maintain a constant value6. This makes them useful for storing money and making everyday purchases without worrying about price changes.

Fast and Cheap Transactions

Stablecoins allow for quick and affordable money transfers, especially across borders6. Traditional bank transfers can take days and cost a lot of money, but stablecoin transfers can happen in minutes for very low fees.

24/7 Availability

Unlike banks that close at certain times, stablecoins can be used anytime, anywhere6. You only need a crypto wallet and internet connection to send or receive stablecoins.

Global Access

Stablecoins provide access to digital dollars for people in countries with unstable local currencies6. This is especially helpful for people in developing countries who want to protect their savings from inflation.

DeFi Integration

Stablecoins are essential for decentralized finance (DeFi) applications. They are used for lending, borrowing, and earning interest on crypto platforms because their stable value makes them reliable.

Risks and Challenges of Stablecoins

While stablecoins offer many benefits, they also come with risks that users should understand:

Depeg Risk

Despite their name, stablecoins are not always stable. They can lose their peg to the asset they are supposed to track. This means a $1 stablecoin might trade for $0.95 or $1.05, causing losses for holders.

Research shows that stablecoins often deviate from their target value, and these deviations do not always correct themselves quickly. External factors like interest rate changes, regulatory issues, or internal problems like hacking can cause depegging events.

Centralization Risk

Many popular stablecoins are controlled by centralized companies. These companies can freeze accounts, stop transactions, or even shut down the stablecoin entirely. This goes against the decentralized nature that many people expect from cryptocurrency.

Reserve Risk

For backed stablecoins, there is always a risk that the company does not actually hold enough reserves to support all the coins in circulation. If everyone tried to cash out their stablecoins at the same time, there might not be enough backing assets to pay everyone.

Regulatory Risk

Governments around the world are still figuring out how to regulate stablecoins2. New laws could affect how stablecoins work or even ban them entirely in some countries.

Smart Contract Risk

Stablecoins that use smart contracts can have bugs or vulnerabilities that hackers can exploit7. In 2023, Level Finance lost $1 million due to a flaw in its smart contract that allowed attackers to create stablecoins without proper backing.

Are Stablecoins Really Stable?

The short answer is: not always. While stablecoins are designed to be stable, they face many challenges that can cause their value to fluctuate.

Historical Instability

Several major stablecoin failures have shown that these assets are not as stable as promised:

TerraUSD (UST) was an algorithmic stablecoin that collapsed in May 2022, losing over 60% of its value in a single day. The related Luna token, which was supposed to support UST, fell to nearly zero, wiping out $45 billion in market value.

Tron’s USDD lost its peg to the US dollar in June 2022, showing that even newer stablecoins can face stability issues.

Even established stablecoins like Tether (USDT) have occasionally traded below their $1 target during times of market stress.

Factors Affecting Stability

Several factors can cause stablecoins to become unstable:

Market Demand: When many people want to buy or sell a stablecoin quickly, its price can move away from its target value.

Liquidity Issues: If there are not enough buyers and sellers in the market, even small trades can cause big price changes.

Reserve Problems: Questions about whether a stablecoin has enough backing assets can cause people to lose confidence and sell their coins.

Technical Issues: Problems with the blockchain network or smart contracts can prevent stablecoins from working properly.

Regulatory News: Announcements about new laws or regulations can cause stablecoin prices to fluctuate.

Popular Stablecoins in the Market

Let’s look at some of the most popular stablecoins and how they maintain stability:

Tether (USDT)

Tether is the largest stablecoin by market value, worth over $112 billion as of 20241. It is supposed to be backed by US dollar reserves, but questions about its backing have caused controversy over the years.

USD Coin (USDC)

USDC is issued by regulated companies and claims to be fully backed by US dollars and short-term government bonds. It is considered one of the more transparent stablecoins.

DAI

DAI is a decentralized stablecoin backed by other cryptocurrencies and some traditional assets4. It uses smart contracts to maintain its peg to the US dollar and is popular in DeFi applications.

First Digital USD (FDUSD)

This is a newer stablecoin that aims to provide stability through full backing by US dollars and government securities.

How Stablecoins Maintain Their Peg

Stablecoins use several mechanisms to keep their value stable:

Arbitrage

When a stablecoin’s price moves away from its target, traders can make money by buying the cheap stablecoin and selling it for its target value, or vice versa3. This trading activity helps bring the price back to its peg.

Reserve Management

Companies that issue stablecoins can buy or sell their reserves to influence the stablecoin’s price. If the price is too low, they might buy stablecoins with their reserves. If the price is too high, they might sell more stablecoins.

Algorithmic Controls

Some stablecoins use computer programs that automatically increase or decrease the supply of coins based on demand. When demand is high, more coins are created. When demand is low, coins are removed from circulation.

Redemption Mechanisms

Many stablecoins allow holders to exchange their coins directly with the issuer for the underlying asset3. This provides a way to maintain the peg even when market prices fluctuate.

The Role of Stablecoins in Cryptocurrency

Stablecoins play several important roles in the crypto ecosystem:

Trading Pairs

Many cryptocurrency exchanges use stablecoins as trading pairs instead of regular money. This allows traders to quickly move between different cryptocurrencies without having to convert to and from traditional currency.

Store of Value

Crypto traders often use stablecoins to park their money during volatile market conditions. Instead of converting back to regular money, they can hold stablecoins and quickly re-enter the market when they want to trade.

DeFi Applications

Stablecoins are essential for many decentralized finance applications. They are used for lending, borrowing, liquidity provision, and yield farming because their stable value makes calculations and risk management easier.

Cross-Border Payments

Stablecoins enable fast and cheap international money transfers. People can send stablecoins across borders much faster and cheaper than traditional wire transfers.

Regulatory Landscape for Stablecoins

Governments around the world are paying increasing attention to stablecoins due to their rapid growth and potential impact on the financial system.

United States

US regulators are working on comprehensive stablecoin regulations. They want to ensure that stablecoin issuers have adequate reserves and proper oversight to protect consumers.

European Union

The EU has introduced the Markets in Crypto-Assets (MiCA) regulation, which includes specific rules for stablecoins. These rules require proper backing and regular audits.

Other Countries

Different countries have different approaches to stablecoin regulation. Some embrace them as innovation, while others are more cautious or even ban them entirely.

Future of Stablecoins

The future of stablecoins depends on several factors:

Improved Stability Mechanisms

Developers are working on better ways to maintain stablecoin stability. This includes improved algorithms, better reserve management, and more robust smart contracts.

Regulatory Clarity

Clear regulations could help stablecoins become more stable and trustworthy. When users know that stablecoins are properly regulated and backed, they are more likely to trust and use them.

Central Bank Digital Currencies (CBDCs)

Many central banks are developing their own digital currencies. These government-issued digital currencies could compete with or complement existing stablecoins.

Technological Improvements

Better blockchain technology and smart contracts could make stablecoins more efficient and secure. This could reduce the risks associated with technical failures.

How to Use Stablecoins Safely

If you decide to use stablecoins, here are some tips to stay safe:

Choose Reputable Stablecoins

Stick to well-known stablecoins with good track records and transparent operations. Avoid new or experimental stablecoins unless you understand the risks.

Understand the Backing

Learn how your chosen stablecoin maintains its stability. Is it backed by real assets? Does it use algorithms? Understanding the mechanism helps you assess the risks.

Don’t Put All Your Money in One Stablecoin

Diversify across different stablecoins to reduce risk. If one stablecoin fails, you won’t lose everything.

Keep Up with News

Stay informed about regulatory changes and news that could affect stablecoins. This helps you make informed decisions about when to hold or sell.

Use Secure Wallets

Store your stablecoins in secure wallets that you control. Avoid leaving large amounts on exchanges where you don’t control the private keys.

Stablecoins vs Traditional Money

Stablecoins offer some advantages over traditional money, but they also have drawbacks:

Advantages

- Speed: Stablecoin transactions can be much faster than bank transfers

- Cost: Lower fees for international transfers

- Accessibility: Available 24/7 without bank restrictions

- Programmability: Can be used in smart contracts and automated systems

Disadvantages

- Stability Risk: Not guaranteed to maintain their peg

- Technical Complexity: Require understanding of cryptocurrency technology

- Regulatory Uncertainty: Rules are still being developed

- Limited Acceptance: Not accepted everywhere like traditional money

The Technology Behind Stablecoins

Stablecoins rely on blockchain technology to function:

Blockchain Networks

Most stablecoins run on popular blockchain networks like Ethereum, Binance Smart Chain, or Tron. These networks provide the infrastructure for creating, transferring, and managing stablecoins.

Smart Contracts

Many stablecoins use smart contracts to automate their operations. These computer programs can automatically mint new coins, burn existing coins, or execute other functions based on predefined rules.

Oracles

Some stablecoins use oracles to get real-world price information. Oracles are services that provide external data to blockchain applications, helping stablecoins know the current price of their target asset.

Common Misconceptions About Stablecoins

There are several misconceptions about stablecoins that users should be aware of:

“Stablecoins Are Always Safe”

While stablecoins are designed to be stable, they can still lose value or fail completely. Users should understand the risks involved.

“All Stablecoins Are the Same”

Different stablecoins use different mechanisms to maintain stability. Some are riskier than others, and users should understand these differences.

“Stablecoins Are Guaranteed by the Government”

Most stablecoins are not backed by government guarantees. They rely on private companies or algorithms to maintain their value.

“Stablecoins Can’t Lose Their Peg”

History has shown that stablecoins can and do lose their peg to their target assets. This can result in losses for holders.

Impact of Stablecoins on Global Finance

Stablecoins are having a significant impact on the global financial system:

Financial Inclusion

Stablecoins provide access to stable digital currency for people who don’t have access to traditional banking services. This is particularly important in developing countries with unstable local currencies.

Remittances

Stablecoins offer a cheaper and faster way to send money across borders. This could significantly reduce the cost of remittances for migrant workers.

Monetary Policy

The growth of stablecoins could affect how central banks implement monetary policy. If people use stablecoins instead of local currency, it could reduce the effectiveness of traditional monetary tools.

Financial Stability

Large stablecoin failures could potentially impact the broader financial system, which is why regulators are paying close attention to their development.

Conclusion

Stablecoins represent an important innovation in the cryptocurrency space, offering the potential for stable digital money that combines the benefits of blockchain technology with price stability. However, as we have seen, they are not always as stable as their name suggests.

Whether stablecoins are truly stable remains an open question. While they offer many benefits and have the potential to revolutionize digital payments, their track record shows that stability is not guaranteed. Users should approach stablecoins with realistic expectations and a thorough understanding of the risks and benefits involved.