Should You Switch to a Neobank? Discover the Powerful Truth

Exploring the Pros, Cons, and Realities of Modern Digital Banking

A neobank is a modern bank that operates only online. Unlike traditional banks, which have physical branches on every corner, neobanks exist in the digital world. This means you can do all your banking from your phone or computer, without ever needing to visit a branch.

Neobanks are designed for people who want banking to be fast, easy, and convenient. They use technology to make everything from opening an account to sending money as simple as possible.

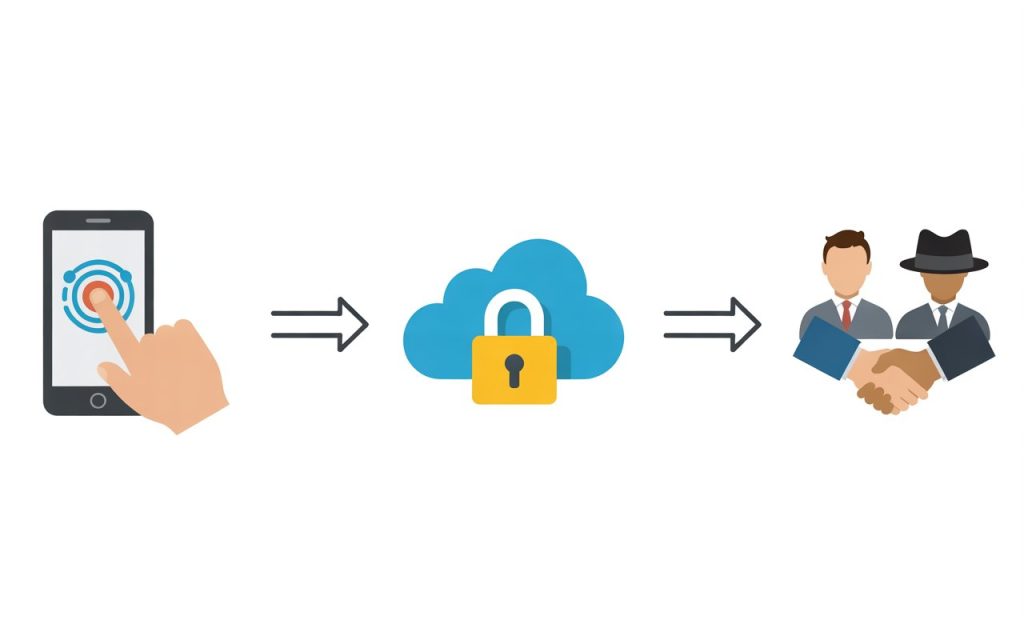

Many neobanks are actually not banks themselves but work with real banks behind the scenes. This partnership allows them to offer real bank accounts and services without having to build their own branches.

Neobanks are popular with young people, tech-savvy users, and anyone who wants to avoid the hassle of traditional banking. They are especially useful for people who travel a lot or live in different countries, as many neobanks offer international accounts and low-cost currency exchange.

How Do Neobanks Work?

Neobanks use mobile apps and websites to provide all their services. When you sign up for a neobank, you usually just need your phone, an email address, and some basic personal information. The process is fast and can often be done in minutes.

Once your account is open, you can do everything you need right from the app. This includes checking your balance, sending money to friends, paying bills, and setting up savings goals.

Because neobanks do not have to pay for buildings or lots of staff, they can keep their costs low. This means they often have lower fees and better interest rates than traditional banks.

Some neobanks also offer extra features like budgeting tools, spending insights, and instant notifications. These tools help you keep track of your money and make better financial decisions.

Many neobanks also offer virtual or physical debit cards. These cards work just like a regular bank card and can be used anywhere that accepts card payments.

Why Are Neobanks Becoming Popular?

Neobanks are becoming popular for many reasons. The most important is convenience. With a neobank, you can do all your banking from your phone, anytime and anywhere. You do not need to visit a branch or wait in line.

Another reason is cost. Neobanks often have lower fees than traditional banks. Some even offer free accounts with no monthly charges. This is a big advantage for people who want to save money.

Neobanks also make it easy to manage your money. Their apps are designed to be simple and user-friendly. You can see all your transactions, set savings goals, and get instant alerts about your account.

For people who travel or live abroad, neobanks are especially useful. Many offer multi-currency accounts and low-cost international transfers. This makes it easy to manage money in different countries.

Finally, neobanks are popular with young people and tech-savvy users. They are used to doing everything online and expect banking to be just as easy as ordering food or booking a ride.

The Benefits of Using a Neobank

There are many benefits to using a neobank. Here are some of the most important ones:

- Lower Fees: Many neobanks do not charge monthly fees or have very low fees compared to traditional banks. This can save you a lot of money over time.

- Better Interest Rates: Some neobanks offer higher interest rates on savings accounts. This means your money can grow faster.

- Easy to Use: The apps are designed to be simple and user-friendly. You can do everything from your phone, without needing to visit a branch.

- Fast Service: Opening an account or getting support is quick and easy. You can often get help instantly through the app or chat.

- Extra Features: Many neobanks offer budgeting tools, savings goals, and spending insights. These features help you manage your money better.

- International Banking: Many neobanks offer multi-currency accounts and low-cost international transfers. This is great for travelers and expats.

- Instant Notifications: You get instant alerts about your account activity. This helps you keep track of your money and spot any problems quickly.

The Downsides of Neobanks

While neobanks have many benefits, there are also some downsides to consider:

- No Physical Branches: If you like to talk to someone face-to-face, neobanks may not be for you. All support is done online or by chat.

- Limited Services: Some neobanks do not offer all the services of a traditional bank, like mortgages, business accounts, or investment products.

- Customer Support: Support is usually online or by chat. Some people prefer to talk to someone in person or on the phone.

- Cash Deposits: Most neobanks do not accept cash deposits. You need to transfer money from another bank.

- Security Concerns: Some people worry about the safety of their money with an online-only bank. However, most neobanks are regulated and insured, just like traditional banks.

Are Neobanks Safe?

Many people worry about the safety of their money with neobanks. The good news is that most neobanks are regulated and insured. This means your money is protected up to a certain amount if something goes wrong.

Before opening an account, always check if the neobank is licensed and insured. You can usually find this information on their website or in the app.

Neobanks also use advanced security features to protect your account. This includes things like two-factor authentication, encryption, and instant alerts for suspicious activity.

If you follow basic security practices, like using a strong password and keeping your app updated, your money should be safe with a neobank.

Who Should Use a Neobank?

Neobanks are a good choice for people who:

- Want to save money on fees

- Like to do everything online

- Want fast and easy banking

- Do not need to visit a branch

- Travel or live abroad

- Are comfortable with technology

If you prefer to talk to someone in person or need services like mortgages or business accounts, a traditional bank might be better for you.

How to Choose a Neobank

When choosing a neobank, consider the following:

- Fees: Look for low or no fees.

- Interest Rates: Compare interest rates on savings accounts.

- Features: Check what features are offered, like budgeting tools or savings goals.

- Customer Support: Make sure you can get help when you need it.

- Security: Check if the neobank is regulated and insured.

- International Services: If you travel or live abroad, look for multi-currency accounts and low-cost international transfers.

How to Switch to a Neobank

Switching to a neobank is easy. Here are the steps:

- Choose a neobank that fits your needs.

- Open an account online or through the app.

- Transfer your money from your old bank to your new neobank account.

- Update your payment details for bills and subscriptions.

- Start using your neobank for everyday banking.

Neobanks vs. Traditional Banks

Here is a more detailed comparison of neobanks and traditional banks:

| Feature | Neobank | Traditional Bank |

|---|---|---|

| Branches | No | Yes |

| Fees | Low or none | Often higher |

| Interest Rates | Often higher | Often lower |

| Customer Support | Online/chat | In-person/phone |

| Services Offered | Limited | Wide range |

| Ease of Use | Very easy | Can be complex |

| International Banking | Yes | Sometimes |

| Cash Deposits | Rarely | Yes |

| Security | High | High |

Real-Life Examples of Neobanks

There are many neobanks around the world. Here are some popular ones and what they offer:

- Revolut: Offers multi-currency accounts, international transfers, and budgeting tools.

- N26: Known for its simple app and fast account opening.

- Monzo: Popular in the UK, with features like savings pots and spending insights.

- Chime: Offers early direct deposit and no hidden fees.

- Varo: Focuses on savings and offers high interest rates.

Each neobank has its own features and benefits. Research them to find the best one for you.

The Future of Neobanks

Neobanks are growing fast. More and more people are choosing them over traditional banks. In the future, neobanks may offer even more services and become even more popular.

Experts predict that neobanks will continue to innovate and improve their offerings. They may start to offer more financial products, like loans, insurance, and investment options.

As technology improves, neobanks will become even easier to use and more secure. This will make them an even better choice for many people.

Common Questions About Neobanks

Here are some common questions people have about neobanks:

Q: Are neobanks real banks?

A: Most neobanks are real banks or partner with real banks. They are regulated and insured, just like traditional banks.

Q: Can I use a neobank for business?

A: Some neobanks offer business accounts, but not all. Check before opening an account.

Q: How do I deposit cash into a neobank?

A: Most neobanks do not accept cash deposits. You need to transfer money from another bank.

Q: What happens if my neobank goes out of business?

A: If your neobank is insured, your money is protected up to a certain amount.

Q: Are neobanks safe?

A: Yes, most neobanks are regulated and insured. They also use advanced security features to protect your money.

Should You Ditch Your Bank for a Neobank?

Whether you should ditch your bank for a neobank depends on your needs. If you want lower fees, better interest rates, and easy online banking, a neobank could be a great choice.

If you need in-person service or a wide range of banking products, a traditional bank might be better.

Many people choose to use both. They keep their main account with a traditional bank and use a neobank for everyday spending and savings.

Tips for Using a Neobank

Here are some tips to help you get the most out of your neobank:

- Keep track of your money using the app’s features.

- Set up alerts for transactions and balances.

- Use budgeting tools to manage your spending.

- Check for updates to get new features and security improvements.

- Use a strong password and enable two-factor authentication.

- Check your account regularly for any suspicious activity.

What Experts Say About Neobanks

Experts say that neobanks are a good option for people who want simple, fast, and cheap banking. They recommend checking if a neobank is regulated and insured before opening an account.

Experts also suggest using a neobank for everyday banking and keeping your main account with a traditional bank for more complex needs.

How Neobanks Are Changing Banking

Neobanks are making banking more accessible and affordable. They are forcing traditional banks to improve their services and lower their fees. This is good news for everyone.

Neobanks are also helping more people get access to banking services. People who could not open an account at a traditional bank can now bank online with a neobank.

The Role of Technology in Neobanks

Neobanks use the latest technology to provide their services. This includes mobile apps, artificial intelligence, and advanced security features. This makes banking safer and more convenient.

Technology also allows neobanks to offer features like instant notifications, spending insights, and budgeting tools. These features help you manage your money better.

Neobanks and Financial Inclusion

Neobanks are helping more people get access to banking services. This is especially important for people who live in remote areas or have trouble opening a traditional bank account.

With a neobank, anyone with a smartphone and internet access can open an account and start banking. This is a big step forward for financial inclusion.

The Challenges Facing Neobanks

Despite their success, neobanks face some challenges:

- Building Trust: Some people do not trust online-only banks.

- Regulation: Neobanks must follow strict rules to protect customers.

- Competition: There are many neobanks and traditional banks competing for customers.

- Limited Services: Some neobanks do not offer all the services of a traditional bank.

How to Get the Most Out of Your Neobank

To get the most out of your neobank, use all the features it offers. Set savings goals, track your spending, and use budgeting tools. This will help you manage your money better.

Also, make sure to keep your app updated and use strong security practices. This will help keep your money safe.

Neobanks and the Global Economy

Neobanks are not just popular in one country. They are growing all over the world. This is changing the way people think about banking and money.

In many countries, neobanks are the fastest-growing part of the banking industry. They are helping to make banking more accessible and affordable for millions of people.

The Impact of Neobanks on Traditional Banks

Traditional banks are feeling the pressure from neobanks. Many are improving their own apps and lowering fees to keep customers.

Some traditional banks are even launching their own neobank brands to compete. This is good news for customers, as it means more choice and better services.

How to Stay Safe with a Neobank

To stay safe with neobanks:

- Use a strong password.

- Enable two-factor authentication.

- Keep your app updated.

- Check your account regularly.

- Do not share your login details with anyone.

- Be careful with phishing emails and scams.

The Power of Neobanks

Neobanks are powerful because they make banking easy and affordable for everyone. They are changing the way people manage their money and are here to stay.

With their focus on technology, convenience, and low fees, neobanks are set to become an even bigger part of the banking world in the years ahead.