Federal vs Private Loan Approval Times 2025

Federal vs Private Student Loan Approval Times Explained

Navigating the differences between federal and private student loan approval times is crucial for students and families preparing to finance a college education. The approval process can seem overwhelming, but knowing the typical timelines for each loan type can help you plan and reduce stress. This guide breaks down federal and private student loan approval times in clear, simple language, including step-by-step explanations, easy-to-read comparison tables, and real-world case studies. By reading on, you’ll learn what to expect, how to get ready, and the best ways to secure your student loan funds quickly and efficiently.

Federal vs Private Student Loan Approval Times: Overview

Federal vs private student loan approval times are not the same. Federal student loans, such as Direct Subsidized, Unsubsidized, or PLUS loans, follow a government process and timeline. Private student loans, offered by banks, credit unions, or online lenders, have their own steps and can sometimes be faster or slower. Understanding the differences in federal vs private student loan approval times helps you choose the best option for your needs and avoid missing important deadlines.

Federal Student Loan Approval Times Explained

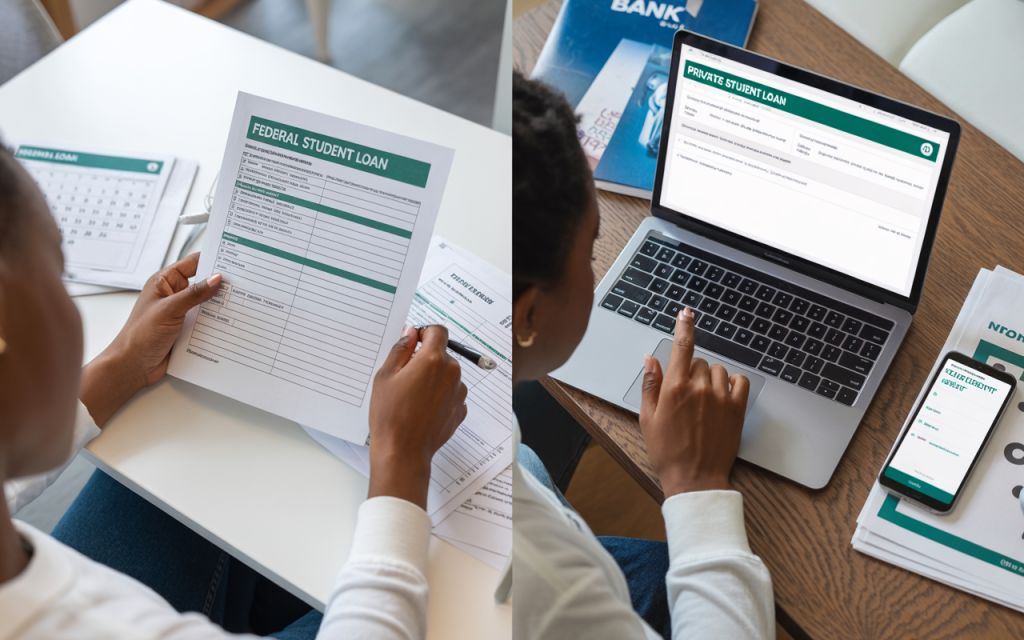

How Federal Student Loan Approval Works

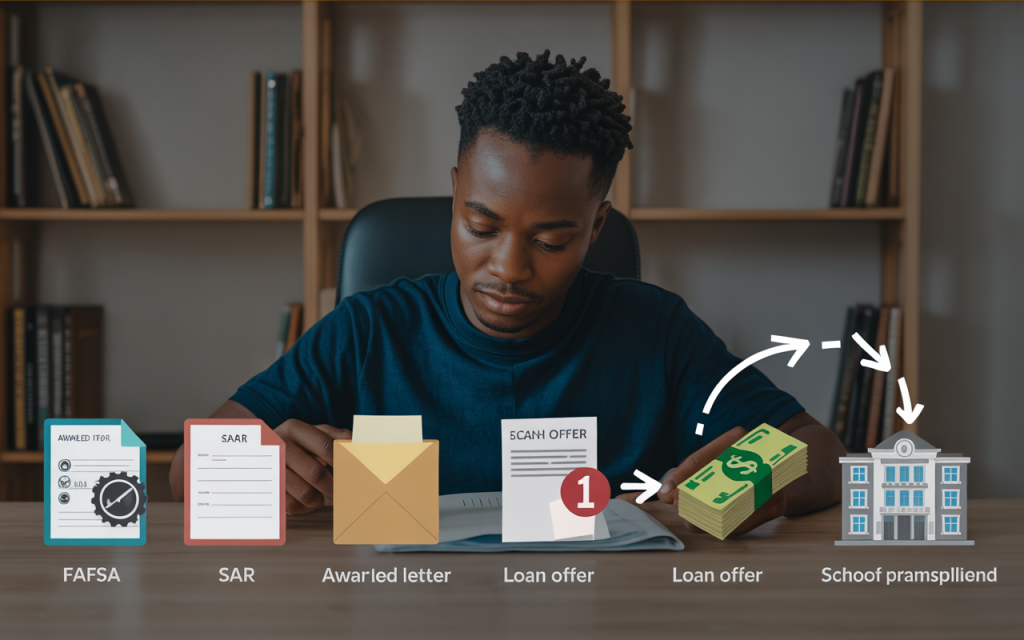

- Step 1: FAFSA Submission

You must complete the Free Application for Federal Student Aid (FAFSA) online or by mail. - Step 2: Student Aid Report (SAR)

After submitting the FAFSA, you receive a Student Aid Report (SAR) in 3–5 days (online) or up to 3 weeks (paper). - Step 3: School Processing

Your college or university reviews your FAFSA and sends you a financial aid award letter, usually within 1–3 weeks of receiving your SAR. - Step 4: Loan Acceptance

You review and accept the loan offer as part of your aid package. - Step 5: Disbursement

Funds are sent directly to your school at the start of the academic term.

Typical Federal Student Loan Approval Times

- Online FAFSA: 2–6 weeks from application to disbursement.

- Paper FAFSA: 4–8 weeks from application to disbursement.

What Makes Federal Approval Times Unique?

- No credit check for most loans (except PLUS).

- Follows a set government process with required school certification.

- Disbursement is tied to the school’s academic calendar.

Private Student Loan Approval Times Explained

How Private Student Loan Approval Works

- Step 1: Application Submission

Apply directly with a lender (bank, credit union, or online lender). - Step 2: Credit and Income Review

Lender reviews your credit history and may require a co-signer. You may need to provide income and employment details. - Step 3: Conditional Approval

Some lenders offer instant or same-day pre-approval, but full approval can take 1–3 weeks. - Step 4: School Certification

After approval, your school must certify your enrollment and the loan amount, which can add 1–2 weeks. - Step 5: Disbursement

Funds are sent to your school (and sometimes to you for living expenses).

Typical Private Student Loan Approval Times

- Fastest (with instant pre-approval): 1 week

- Average: 2–4 weeks from application to disbursement

What Makes Private Approval Times Unique?

- Credit checks and co-signer requirements can cause delays.

- Each lender has its own process and speed.

- School certification is still required, which can add time.

Federal vs Private Student Loan Approval Times: Key Steps

Key Steps for Federal Loans

- Complete FAFSA

- Receive SAR

- School processes and sends award letter

- Accept loan offer

- Funds disbursed to school

Key Steps for Private Loans

- Apply with lender

- Credit and income review (with co-signer if needed)

- Approval or denial from lender

- School certifies loan

- Funds disbursed to school

Factors Affecting Federal vs Private Student Loan Approval Times

1. Application Accuracy

- Missing or incorrect information can delay both federal and private loan approvals.

2. Creditworthiness and Co-Signer

- Private loans require credit checks and may need a co-signer, which can add time.

3. School Processing Speed

- Both federal and private loan approvals depend on how quickly your school certifies the loan.

4. Time of Year

- Peak application periods (summer and early fall) can slow down processing for both types.

5. Type of Loan

- Federal loans have a set process, while private loans vary by lender.

Federal vs Private Student Loan Approval Times: Table Comparison

| Step/Factor | Federal Loan | Private Loan |

|---|---|---|

| Application | FAFSA (online/paper) | Lender’s form (online) |

| Credit Check | No (except PLUS) | Yes (co-signer often) |

| School Certification | Yes | Yes |

| Approval Notification | 1–3 weeks | 1 day–3 weeks |

| Disbursement | Start of term | Start of term |

| Typical Timeline | 2–6 weeks (online) | 2–4 weeks |

| Fastest Possible | 2 weeks | 1 week (with instant pre-approval) |

| Most Common Delay | School processing | Credit/co-signer review |

Case Studies: Federal vs Private Student Loan Approval Times

Case Study 1: Federal Student Loan for a First-Year Student

Background:

A first-year student in Abuja submitted the FAFSA online in June.

Timeline:

- Student Aid Report received in 4 days.

- School processed the application and sent an award letter after 2 weeks.

- Loan accepted, funds ready by August.

Total Time: About 6 weeks from application to funding.

Case Study 2: Private Student Loan for a Graduate Student

Background:

A graduate student in Lagos applied for a private loan with a co-signer.

Timeline:

- Instant pre-approval, but full approval took 10 days due to extra income verification.

- School certified the loan in 1 week.

- Funds disbursed 2 days before classes began.

Total Time: About 3 weeks from application to funding.

Case Study 3: Comparing Federal vs Private Student Loan Approval Times

Background:

Two friends, one using a federal loan and the other a private loan, both applied in July.

Federal Loan:

- FAFSA submitted, SAR in 5 days, school processed in 2 weeks, funds ready in 6 weeks.

Private Loan:

- Application approved in 1 week, school certified in 1 week, funds ready in 2.5 weeks.

Result:

The private loan was faster, but required more paperwork and a co-signer.

How to Speed Up Federal vs Private Student Loan Approval Times

1. Apply Early

- Start your application as soon as possible, especially for federal loans.

2. Double-Check Your Application

- Ensure all information is accurate and complete to avoid delays.

3. Respond Quickly

- Reply to requests for more information or documents immediately.

4. Use Online Applications

- Digital submissions are processed faster than paper forms.

5. Prepare Your Co-Signer (if needed)

- For private loans, have your co-signer’s details and documents ready in advance.

6. Communicate with Your School

- Ask your school’s financial aid office about their processing times and follow up as needed.

7. Track Your Application

- Use online portals or apps to monitor your application status and set reminders for deadlines.

Frequently Asked Questions: Federal vs Private Student Loan Approval Times

Q: Which is faster, federal or private student loan approval?

A: Private loans can be faster if you have strong credit and a prepared co-signer, but federal loans are more predictable.

Q: Can I get federal or private loan approval in one day?

A: Some private lenders offer instant pre-approval, but full approval and funding usually take at least a week. Federal loans follow a set process and usually take 2–6 weeks.

Q: What causes delays in student loan approval?

A: Common causes include missing documents, slow school certification, credit issues, or peak application periods.

Q: When will I receive my loan money?

A: Funds are typically sent to your school at the start of the academic term, after approval and certification.

Q: Can I apply for both federal and private loans?

A: Yes, but always maximize federal aid first, as it usually has better terms.

Conclusion: Federal vs Private Student Loan Approval Times

Federal vs private student loan approval times differ in process, speed, and requirements. Federal loans are reliable and follow a set timeline, usually taking 2–6 weeks from application to funding. Private loans can be faster—sometimes as quick as one week—but require credit checks, co-signers, and more paperwork. Delays can happen with both types, especially during busy periods or if documents are missing. To speed up your federal vs private student loan approval times, apply early, double-check your application, respond quickly to requests, and stay in touch with your school and lender. With careful planning, you can get your student loan funds in time for your education in 2025.